GameStop’s stock may have gotten a little ahead of fundamentals in January, but everything that has transpired behind-the-scenes since then may be leading to a massive reevaluation.

GameStop’s transformation from a struggling brick-and-mortar retailer into a technology company that will soon unveil GameStop NFT — a gas-free, consumer-facing, blockchain marketplace — may become one of the greatest turnaround stories in business. All the while, the company has remained silent and the financial media refuses to cover it.

If you’ve been following along since GMEdd.com’s inception almost a year ago, you already know the prologue, but for those who are new here: buckle-up and welcome aboard.

Glassware and Dog Food

The story begins long ago with a mentor’s inspiring devotion to his business…

Ted Cohen was a glassware importer with an impeccable work ethic, who reportedly never missed a day on the job. He led by example, but not in a deliberate way. “It’s who he was,” his son says.

Ted Cohen pictured on the left.

With a keen eye for capital allocation, the disciplined leader kept track of the expenses that most entrepreneurs forget about. Power bills, the varying prices of hundreds of glassware products that he sold, and even the daily gas prices to accommodate for impacted transportation costs.

If you take a carload of this (pointing to a pallet of glassware) you’ll make more money. But if you take a carload of that (pointing to a different pallet), you’ll make less money, but you’ll keep the customer. So, take a carload of that.

Read more on Ted Cohen in Entrepreneur.

Ted Cohen was in it for the long haul. Less concerned with making a “quick buck,” Ted wanted to please his customers. Through his commitment to the business, Ted went on to motivate his son, Ryan, who credits his father’s guiding footsteps in his career.

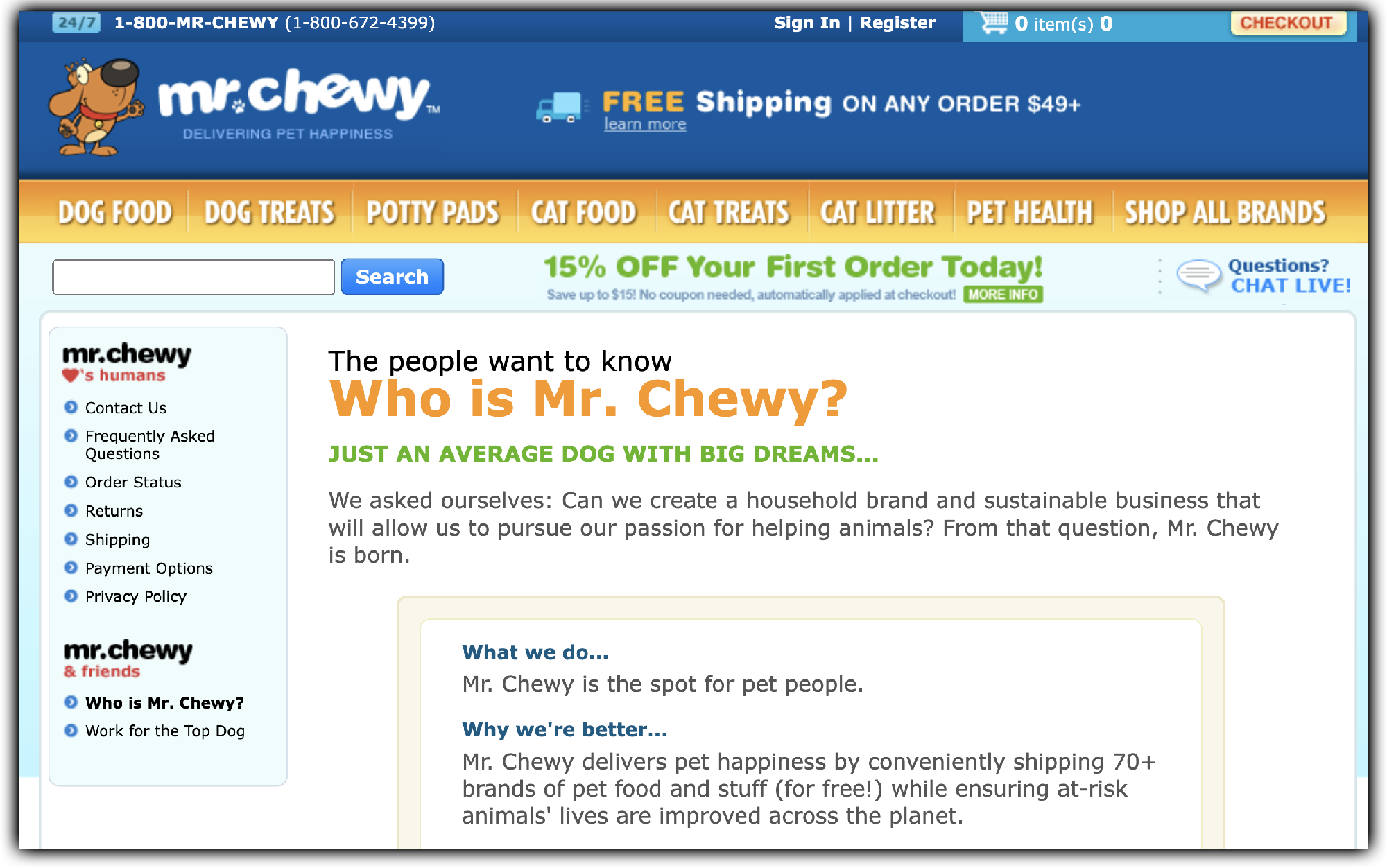

Influenced by his father, the 25-year old Ryan Cohen dropped out of college and founded Chewy, originally MrChewy, with a friend he met in an online chat room. Chewy’s goal was to create a household brand and sustainable business that “delivers pet happiness” through unmatched convenience and customer service.

Joan Verdon at Forbes reports that, back then, Cohen used the 1997 Jeff Bezos letter to Amazon shareholders as a roadmap for how to grow the company. Chewy’s playbook became Bezos’ emphasis on the need to scale, to achieve market leadership, and to make bold bets.

MrChewy as seen in a 2011 screenshot of the site.

In need of capital, Cohen has said he approached over 100 venture capital firms. After being turned away by all of them, Cohen finally secured the company’s first outside investment of $15 million through linking with Larry Cheng of Volition Capital.

From that point on, the mission was larger. I was even more committed to making Chewy an industry leader, because it was no longer just our own money on the line. Larry had gone out on a limb for us. I felt that responsibility. [Ryan Cohen in HBR]

By 2016, the pet product retailer had grown to $900 million in sales and had become the number 1 online pet retailer. One year later, Cohen had raised $350 million and was preparing for an IPO.

This all took a turn when PetSmart purchased Chewy for $3.35 billion in the largest e-commerce acquisition of all time. Two years later, PetSmart took Chewy public at a valuation of $8.7 billion.

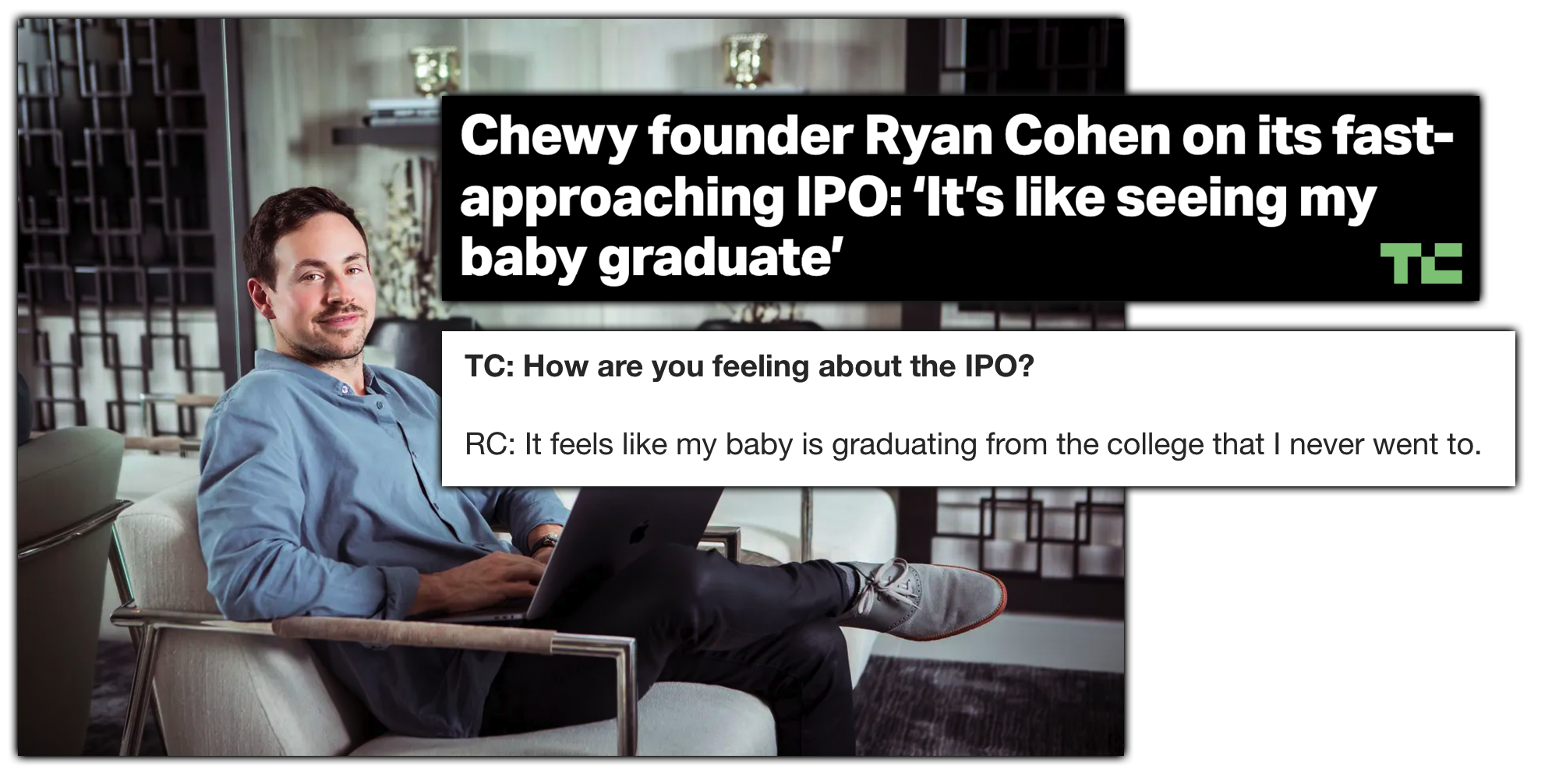

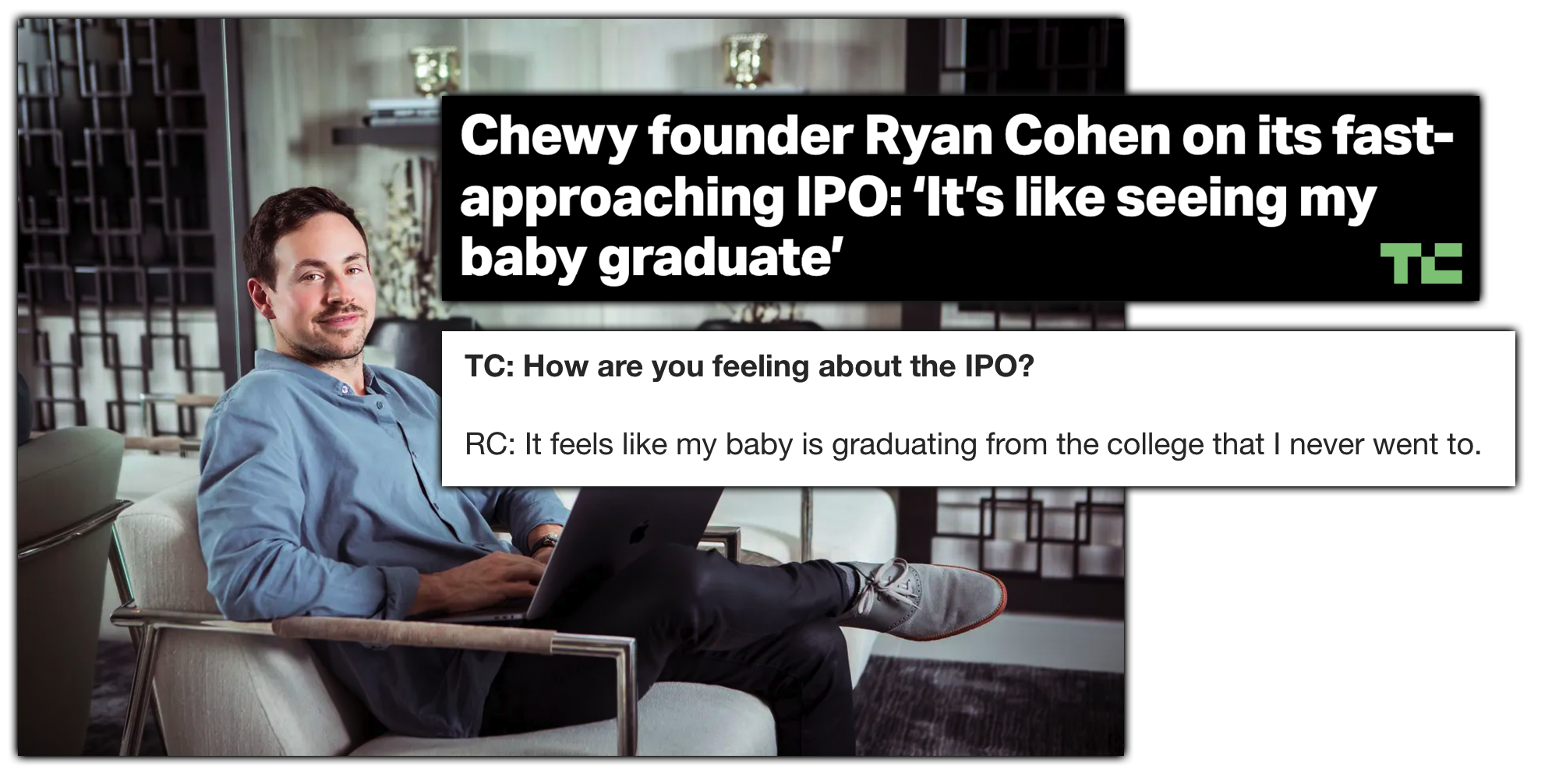

Ryan Cohen has spoken with TechCrunch about Chewy’s IPO.

In an interview with Connie Loizos of TechCrunch, Ryan Cohen referred to Chewy’s IPO as his “baby graduating from the college that he never went to,” and the year of the record-breaking acquisition Fortune named Cohen one of its “40 under 40.”

After continuing to operate as Chewy’s Chief Executive Officer for nearly a year after the sale, Cohen then stepped away from Chewy to begin an exploratory process.

Ryan Cohen considered retirement overrated.

Without any desire to retire at age 33, the relentless entrepreneur began plotting his next move.

I’m lucky. I’m talking to a lot of different entrepreneurs and business[es] and looking at corporate board opportunities. I’m going through that exploratory process.

RC Ventures

In April of 2019, Cohen saw an opportunity with GameStop and invested, pushing the video game retailer to focus on online sales and shutter unprofitable locations.

GameStop had tried and failed to sell itself after years of stagnant growth and corporate strategy missteps. The company hired a new CEO, George Sherman, a veteran of retailers including Advance Auto Parts. Sherman was GameStop’s fifth CEO in less than two years.

At the time, Ryan Cohen was far from being a household name. Living a private life, Cohen had rarely spoken with the press, and GMEdd.com can only cite seven media appearances despite selling a high-profile, multi-billion dollar company prior to his initial GameStop purchase.

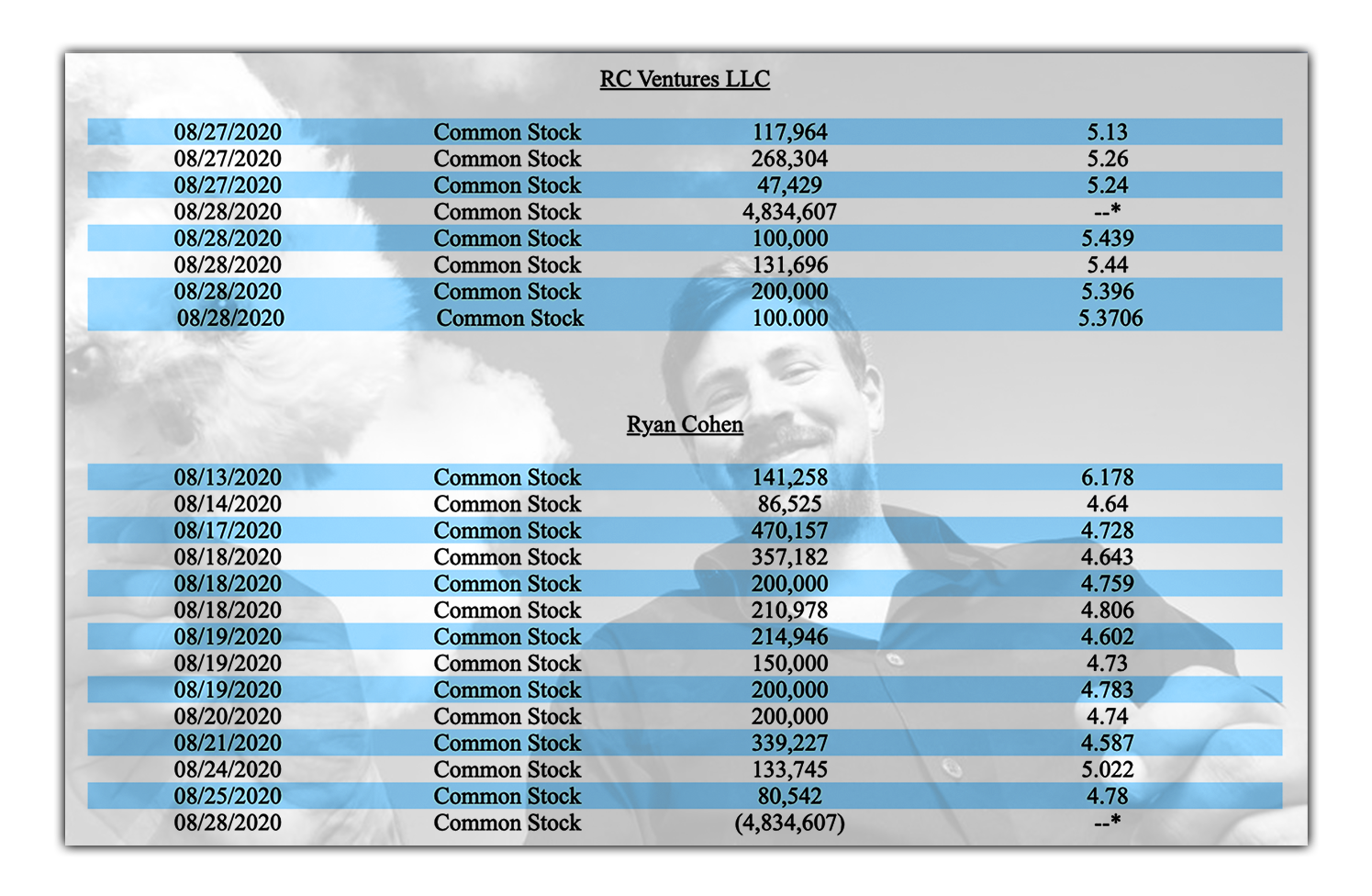

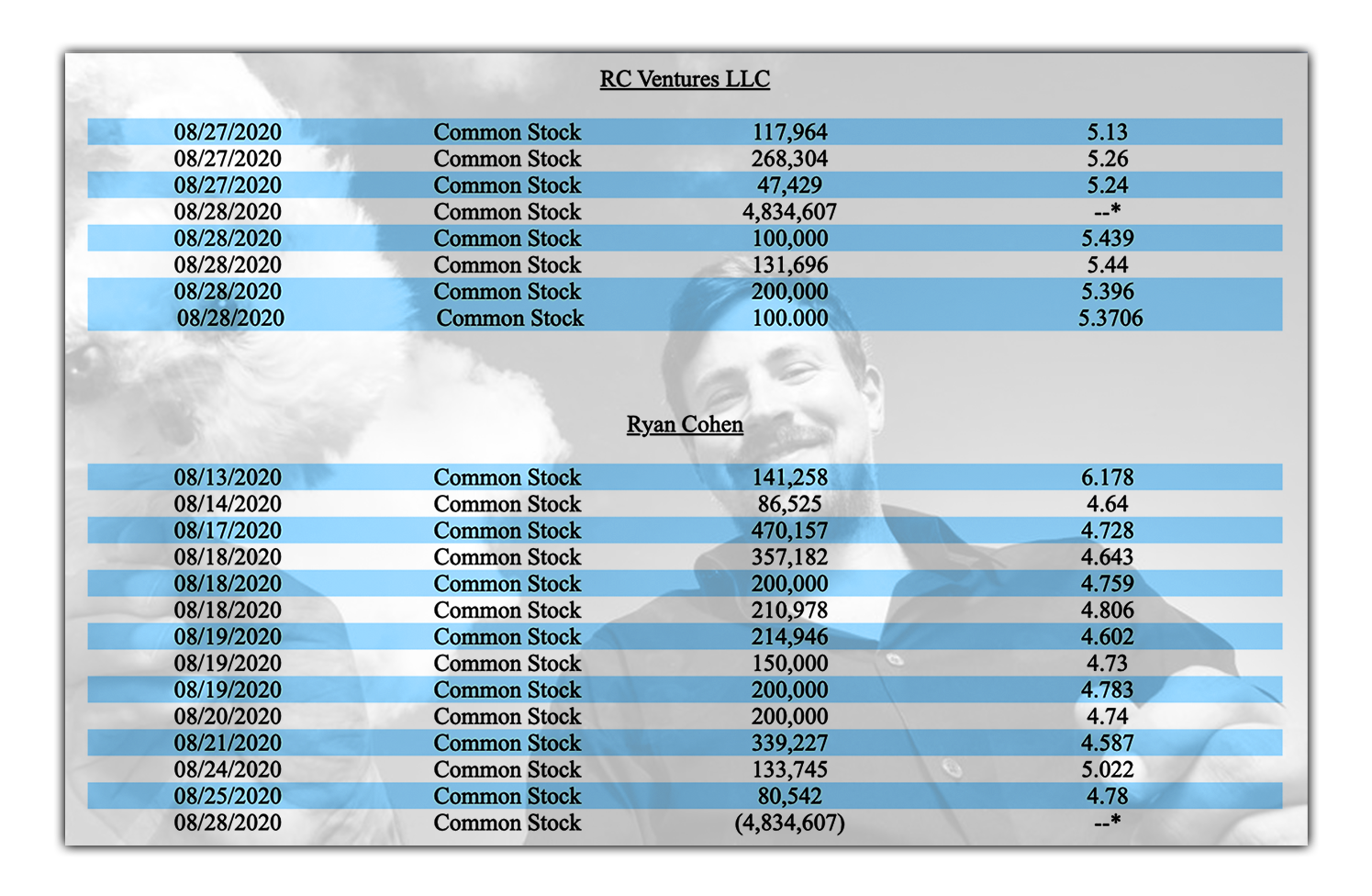

With Cohen down on his GME investment, his suggestions to the board largely ignored, and stock reaching an all-time low of $2.80, the investor executed on an activist approach and upped the ante to a 9% stake, as he filed his first 13D for GameStop via RC Ventures LLC on August 28, 2020.

RC Ventures’ first 13D filing, dated August 28th, 2020.

This sparked waves, particularly within value investor circles, as many pondered the e-commerce guru’s investment motives. What was the Founder of Chewy doing investing in GameStop?

For the past year, Cohen had been perfectly crafting a digital presence, coming out of his private life and conducting more than a dozen interviews, seemingly in an effort to build his credibility as an e-commerce mogul and aid with public support in the event of a proxy battle for control of the company.

When Cohen filed his initial stake in GameStop, traders were interested in the business magnate’s motives and discovered his recently-conducted media sharing his groundbreaking story of beating Amazon in the digital world.

At the time, Cohen had established a website, ryan-cohen.com, that embedded various media appearances and formal interviews the Chewy co-founder had given.

Roaring Kitty was impressed with Ryan Cohen’s success as an entrepreneur.

Retail investing icon Roaring Kitty first stumbles upon Ryan Cohen’s rudimentary homepage during an August 28th, 2020 livestream. At the time, the deep value investor was merely trying to learn more about the Chewy founder.

The website has since been shut down in December of 2020. Had the website done its job?

The Letter and the Agreement

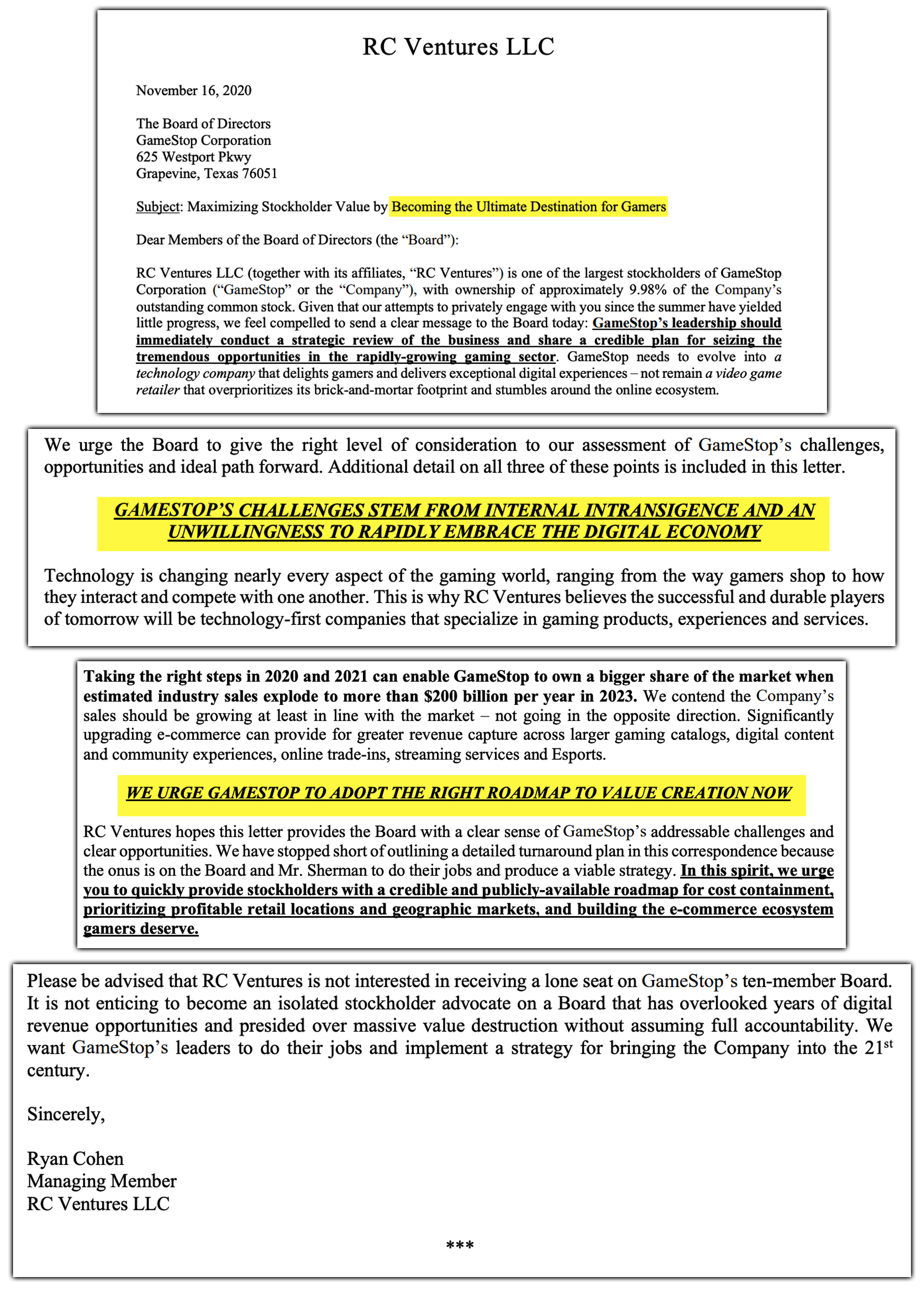

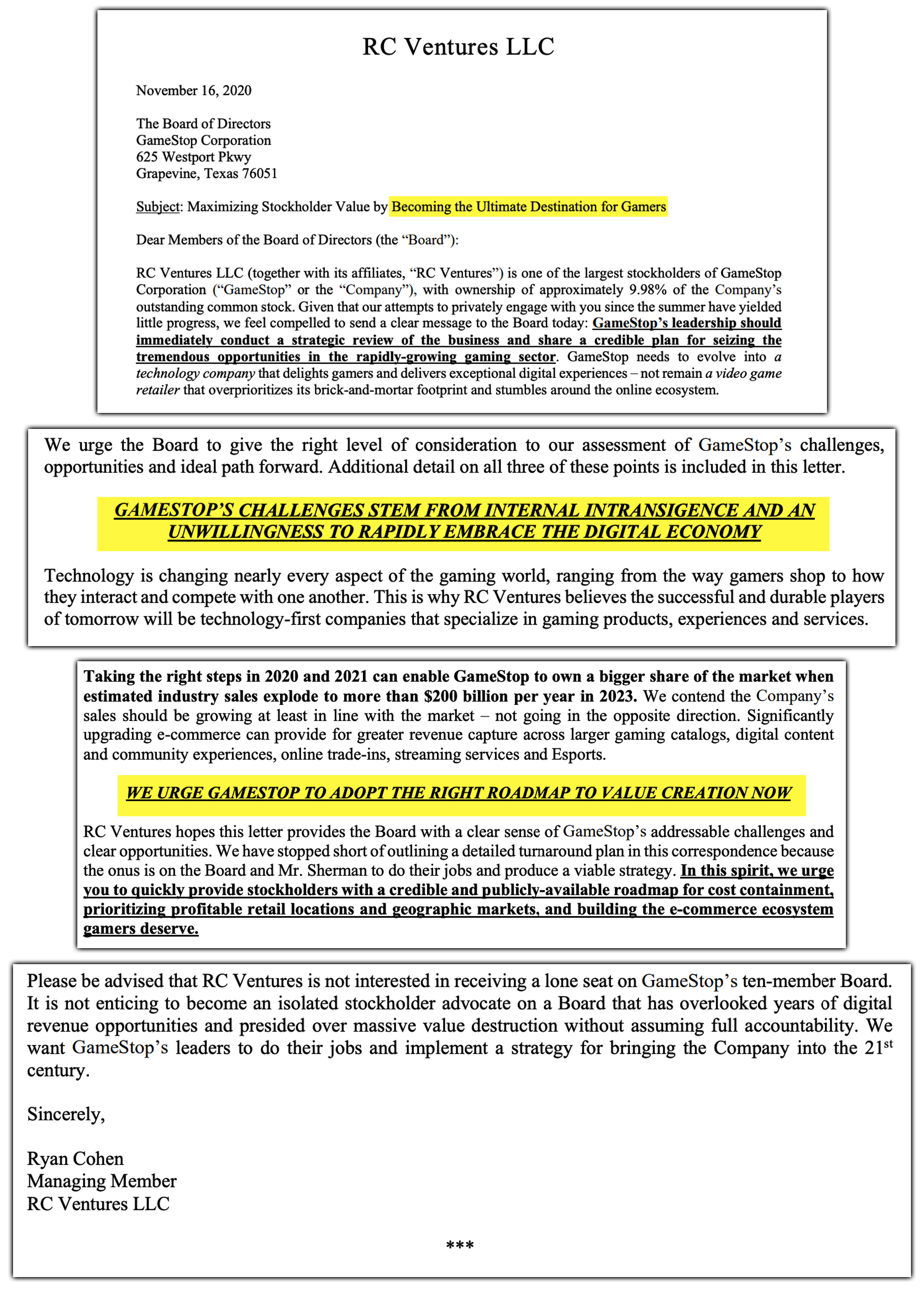

In November of 2020, Ryan Cohen again upped his stake, averaging into a 9.98% position. More importantly, the activist investor amended a letter to the board in his 13D titled, “Maximizing Stockholder Value by Becoming the Ultimate Destination for Gamers.”

Snippets of Cohen’s Letter to GameStop’s Board in November 2020.

In a bold move, Ryan Cohen urged GameStop’s board to adopt the right roadmap to value creation, stating that the company needs to evolve into a technology company that delights gamers.

GAMESTOP’S LEADERSHIP MUST PROMPTLY PIVOT FROM A BRICK-AND-MORTAR MINDSET TO A TECHNOLOGY-DRIVEN VISION

The letter called to attention the ineptitude of then-CEO George Sherman, “Regrettably, Mr. Sherman appears committed to a twentieth-century focus on physical stores and walk-in sales despite the transition to an always-on digital world,” Ryan Cohen wrote.

To this day, the November 2020 letter remains the preeminent voice of Ryan Cohen’s vision regarding the gaming retailer, that all investors should review for an inside-look at his strategy.

The Wall Street Journal reports that the board responded by hosting a private call with Mr. Cohen.

Outraged with a proposed dilutive offering that was never mentioned on the call, Cohen wrote an email to GameStop’s then-chairwoman, Kathy Vrabeck, warning her that he would go public with his disapproval if the company proceeded with the sale. He urged her to share the email with other directors, people familiar with the matter said. [WSJ, Aug. 12, 2021]

“The ill-timed stock offering created a wedge and he used it to his advantage,” a former board member said.

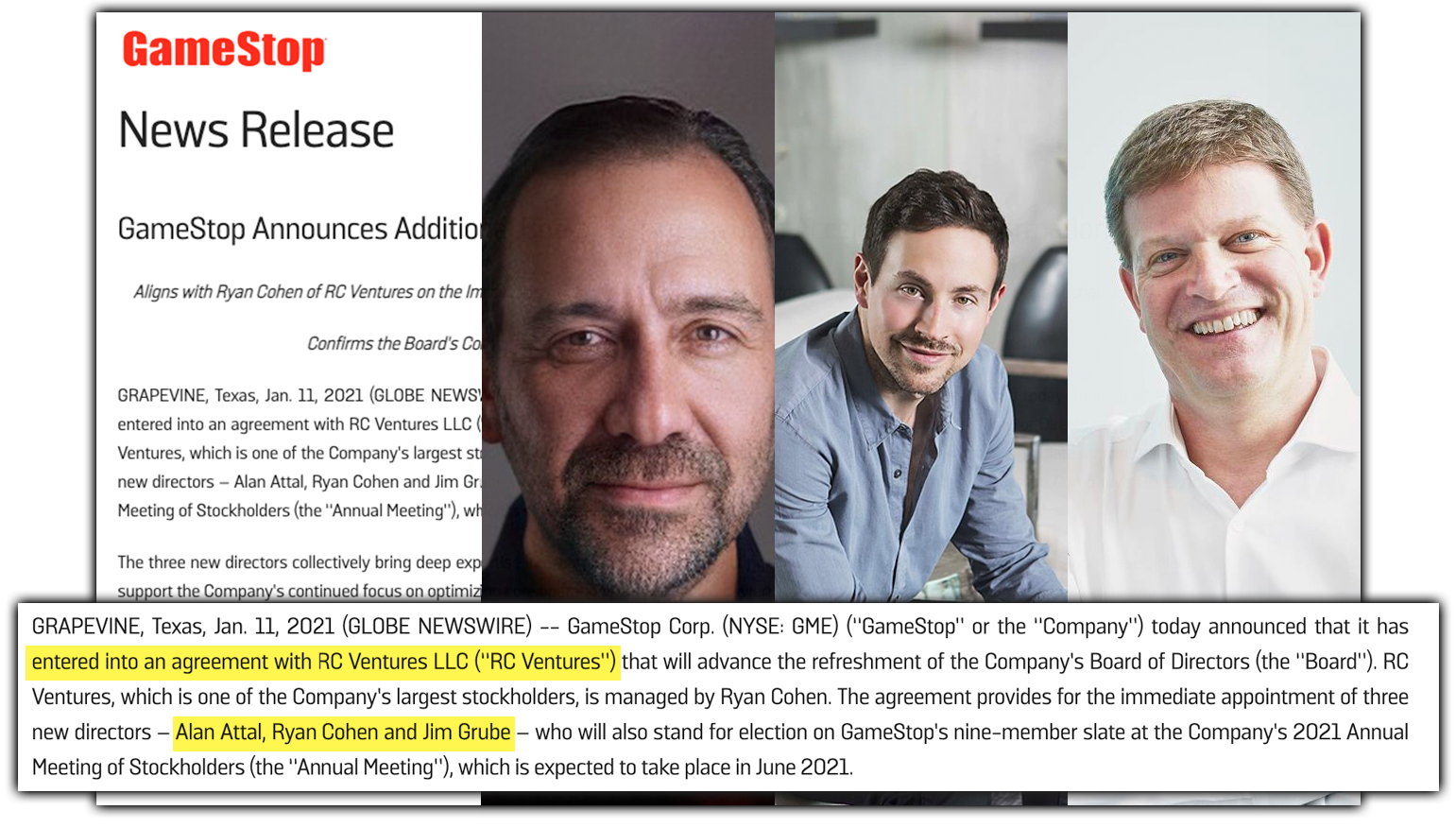

Reportedly leery of a prolonged fight and open to new ideas to improve the business, the board invited Mr. Cohen and two of his associates to join in January.

Read How Ryan Cohen Took Over GameStop – WSJ for more.

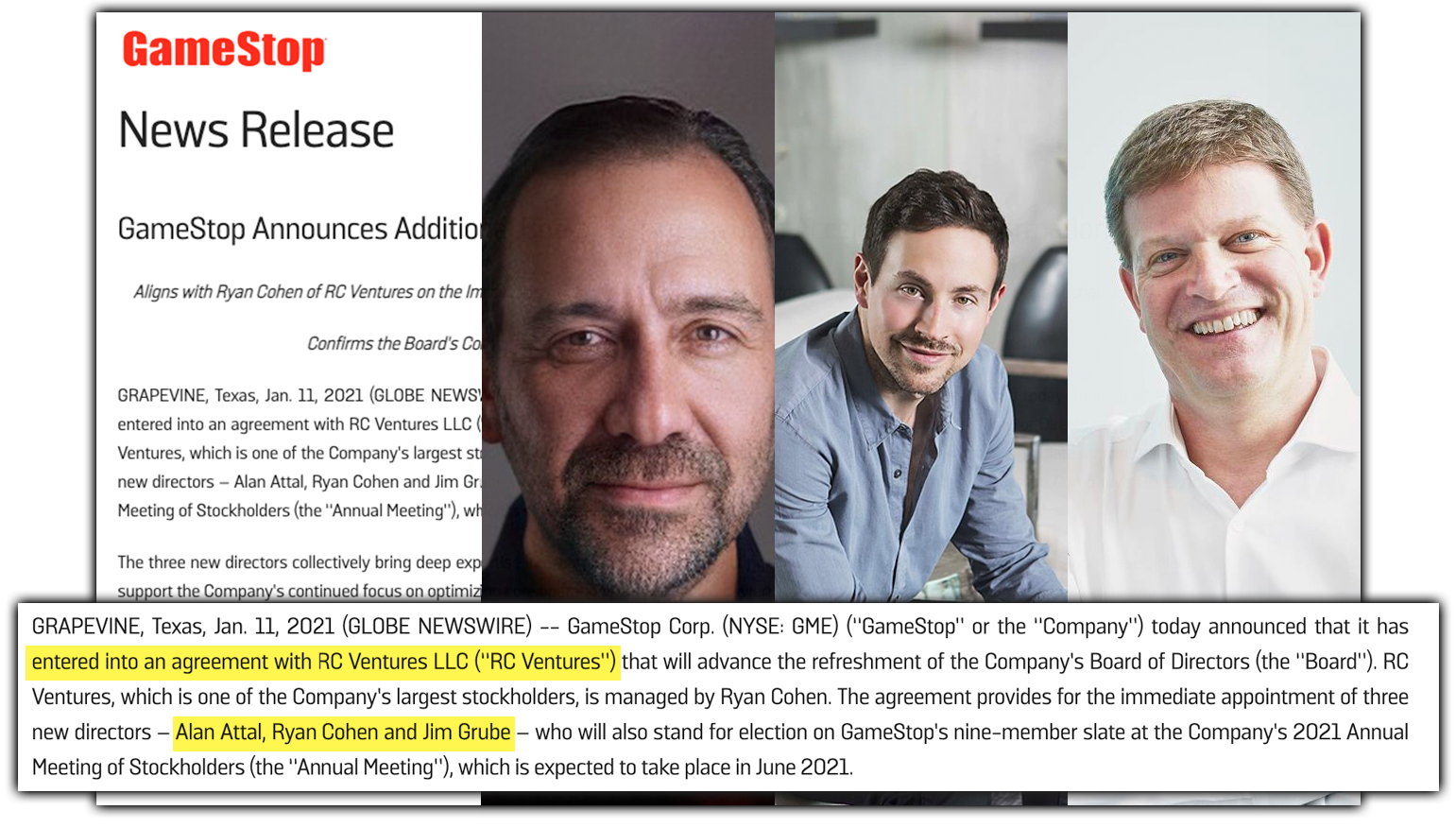

GameStop announced the RC Ventures agreement on January 11th.

With Ryan Cohen and his colleagues from Chewy’s executive suite now appointed to GameStop’s board, the work was just getting started.

Cohen in Charge

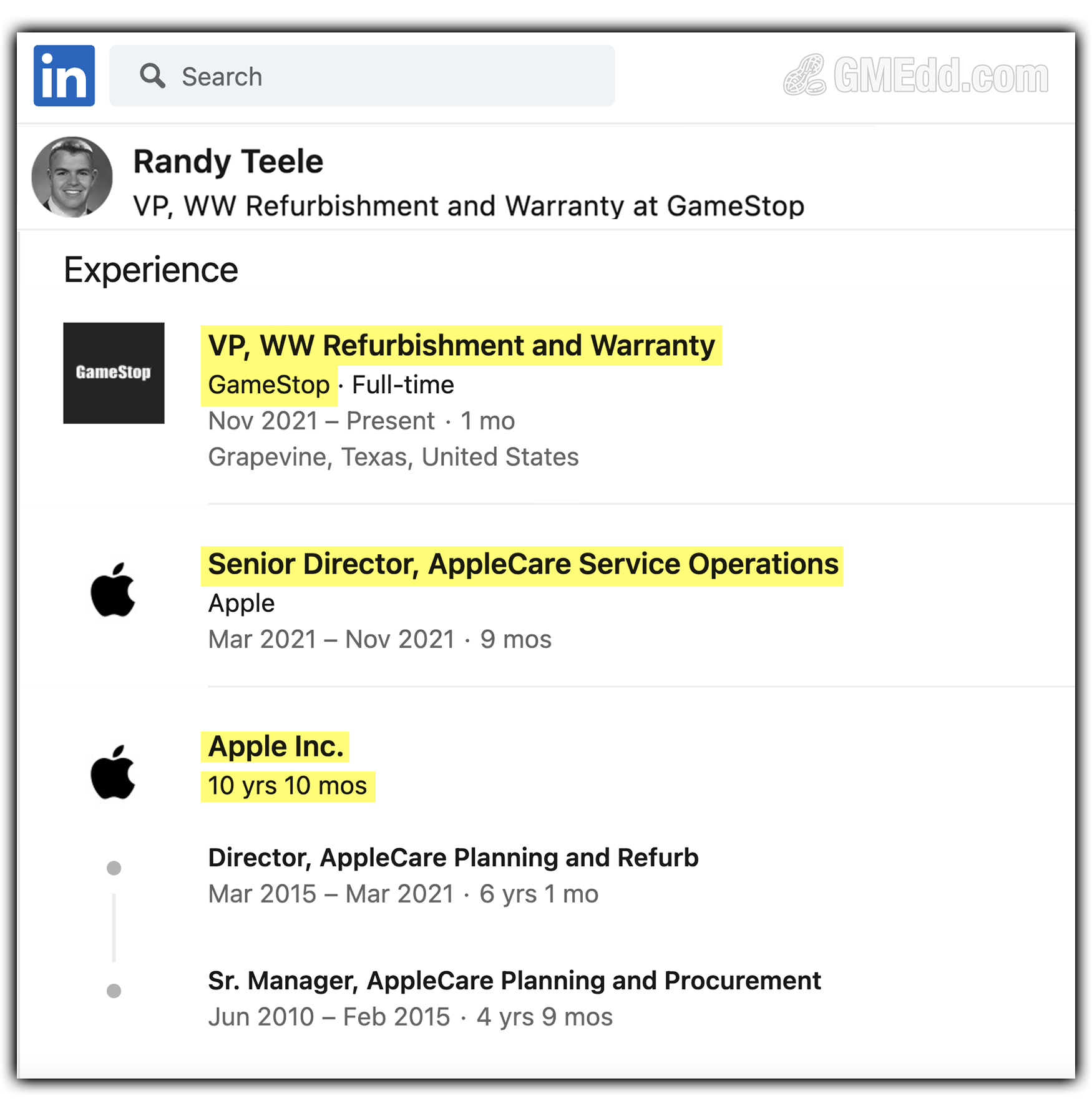

One of GameStop’s first Cohen-lead initiatives was recruiting a Chief Technology Officer, Senior Vice President of Customer Care, and a Vice President of Fulfillment.

All of these appointees came from Amazon and Chewy, with the job titles and work experience indicating a new direction the board member was steering the company towards.

Shortly thereafter, the then-CFO Jim Bell was pushed out and a “hiring frenzy” rapidly ensued.

In May, GMEdd.com published GameStop Poaches Talent From The Best – Amazon, Chewy, Facebook, Google, and More.

As if the decades-old company was a startup once again, tech and e-commerce talent looking to be a part of something began leaving blue-chips in droves to fulfill Cohen’s vision. LinkedIn chatter began hinting towards GameStop gearing up for a transformation that will be studied in universities for years to come.

The stock remained volatile, and in April a new slate for the board was announced, with Chewy’s first investor Larry Cheng nominated for a seat and Ryan Cohen to be elected as Chairman.

At the company’s Annual Shareholders Meeting on June 9th, 2021, the newly-appointed Chairman addressed claims that the company was withholding a roadmap from investors.

We know some people want us to lay out a whole detailed plan today, but that’s not gonna happen. You won’t find us talking a big game, making a bunch of lofty promises, or telegraphing our strategy to the competition. That’s the philosophy we adopted at Chewy.

After months of cheeky tweets from Cohen, GameStop had announced two new fulfillment centers, mirroring Chewy’s locations and strategy. Simultaneously, the company had eliminated all long-term debt and raised nearly $2bn to fund transformation efforts.

GMEdd.com also took note of several job listings and LinkedIn posts that indicated the company would be expanding their corporate footprint from Grapevine to South Florida, Seattle, and Boston in an effort to have a vast pool from which to recruit talent.

The Future of Gaming

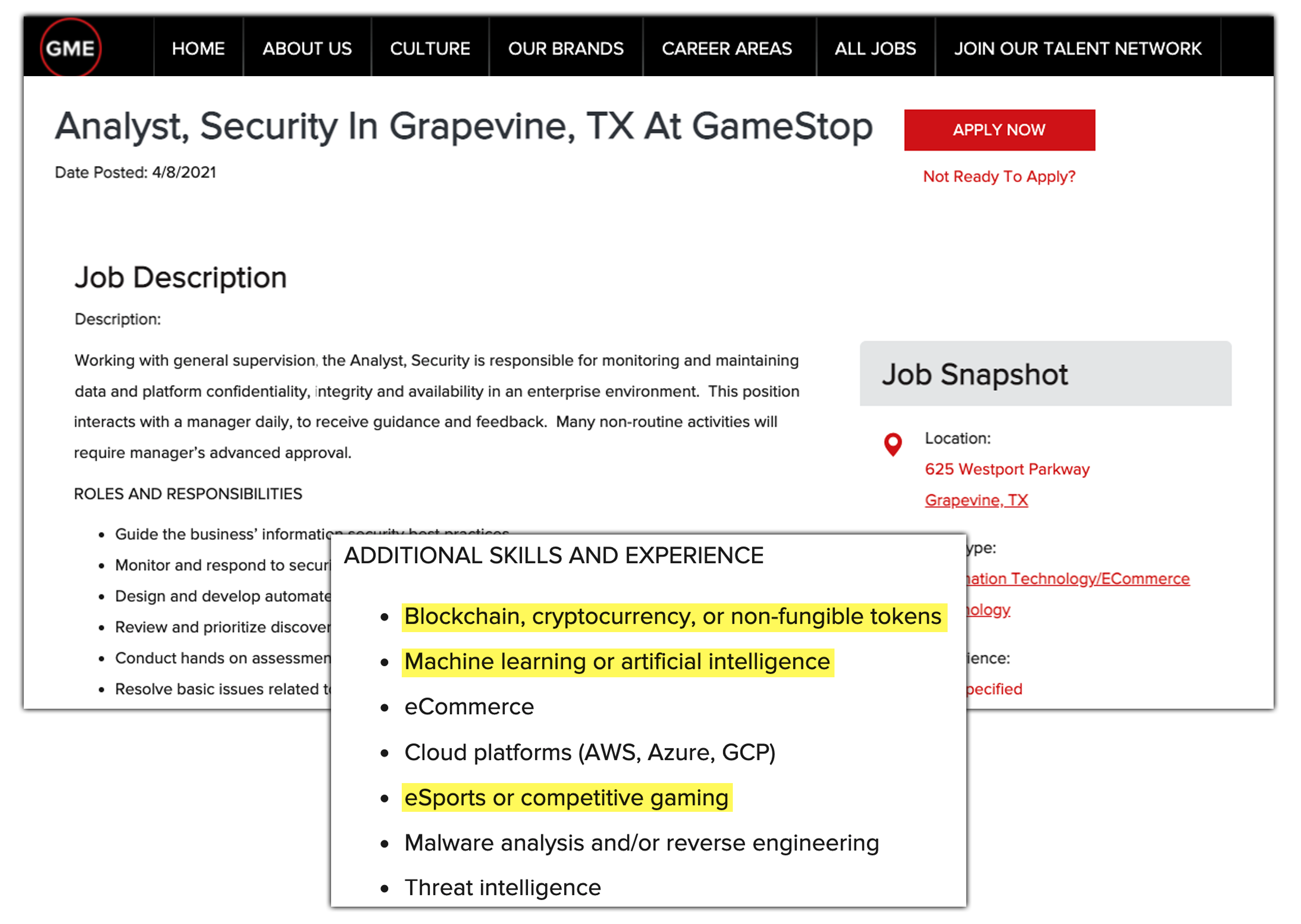

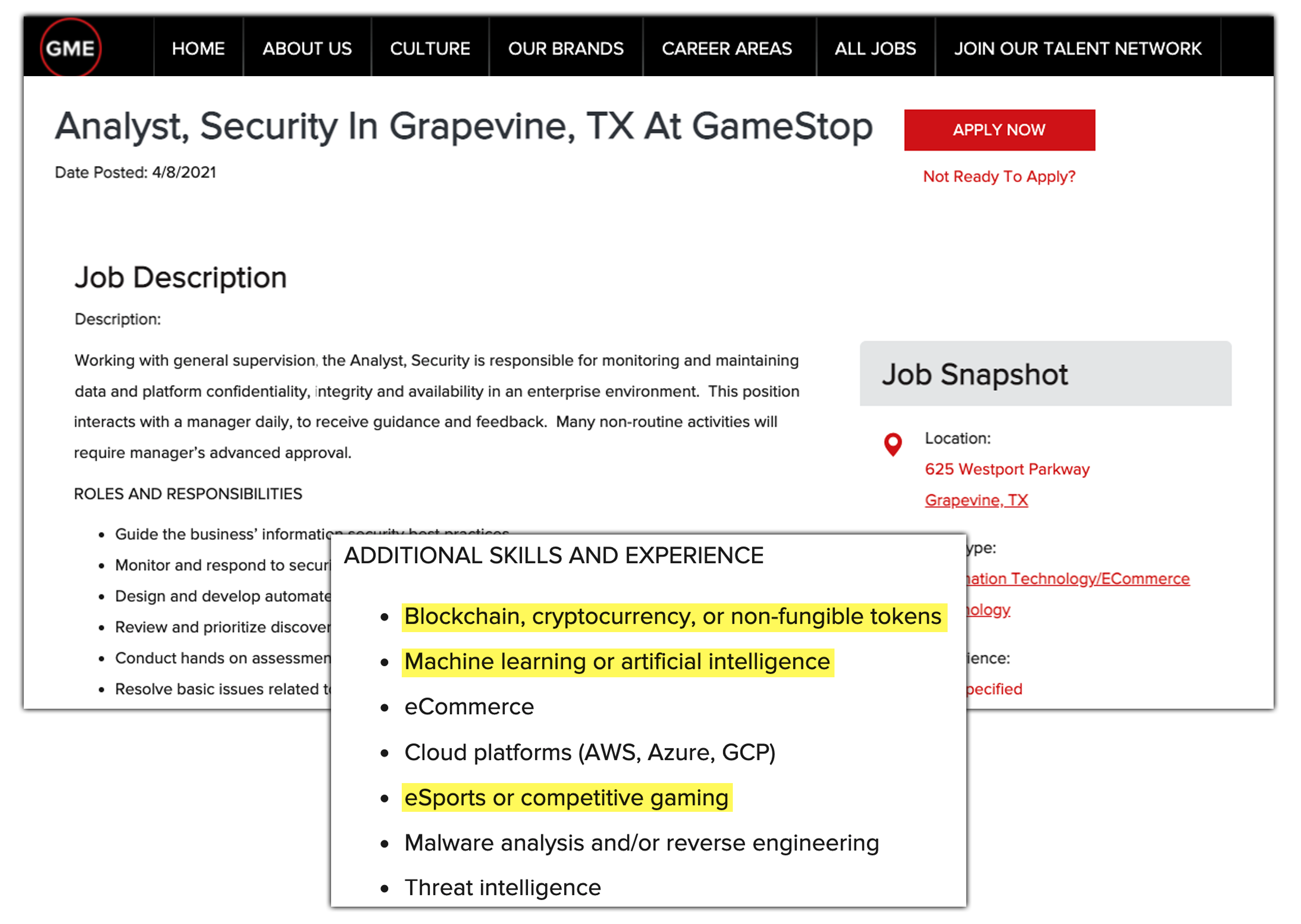

Sprinkled in these job postings were hints that the company was up to something big. GMEdd.com first noted in an otherwise typical job posting from April 8th, 2021, GameStop inadvertently expressed interest in the booming non-fungible tokens market, alongside blockchain and cryptocurrency.

GameStop’s Job Listing from April 8th, 2021

Listed under additional skills and experience, GameStop asked that applicants have experience in: blockchain, cryptocurrency, or non-fungible tokens.

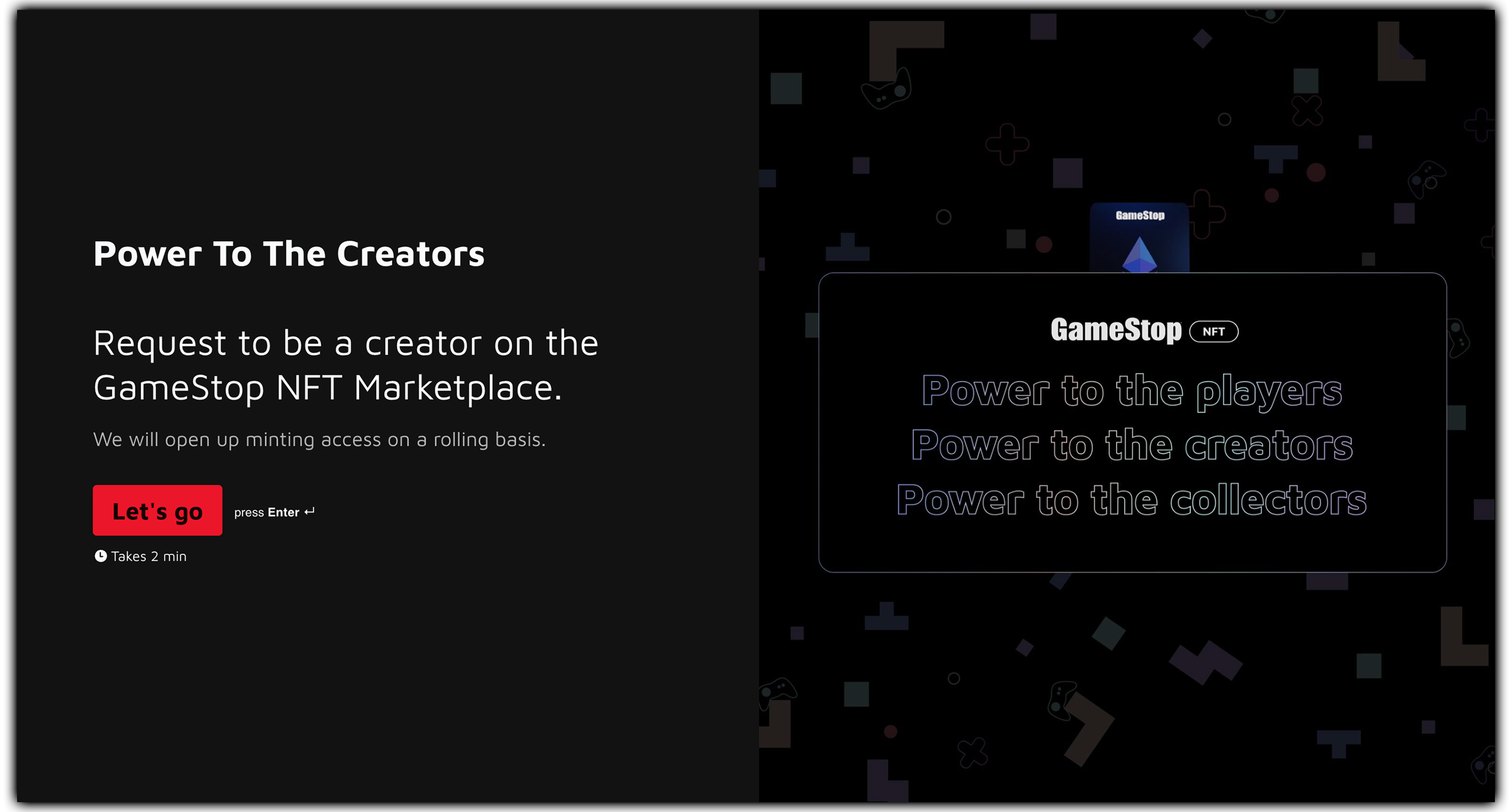

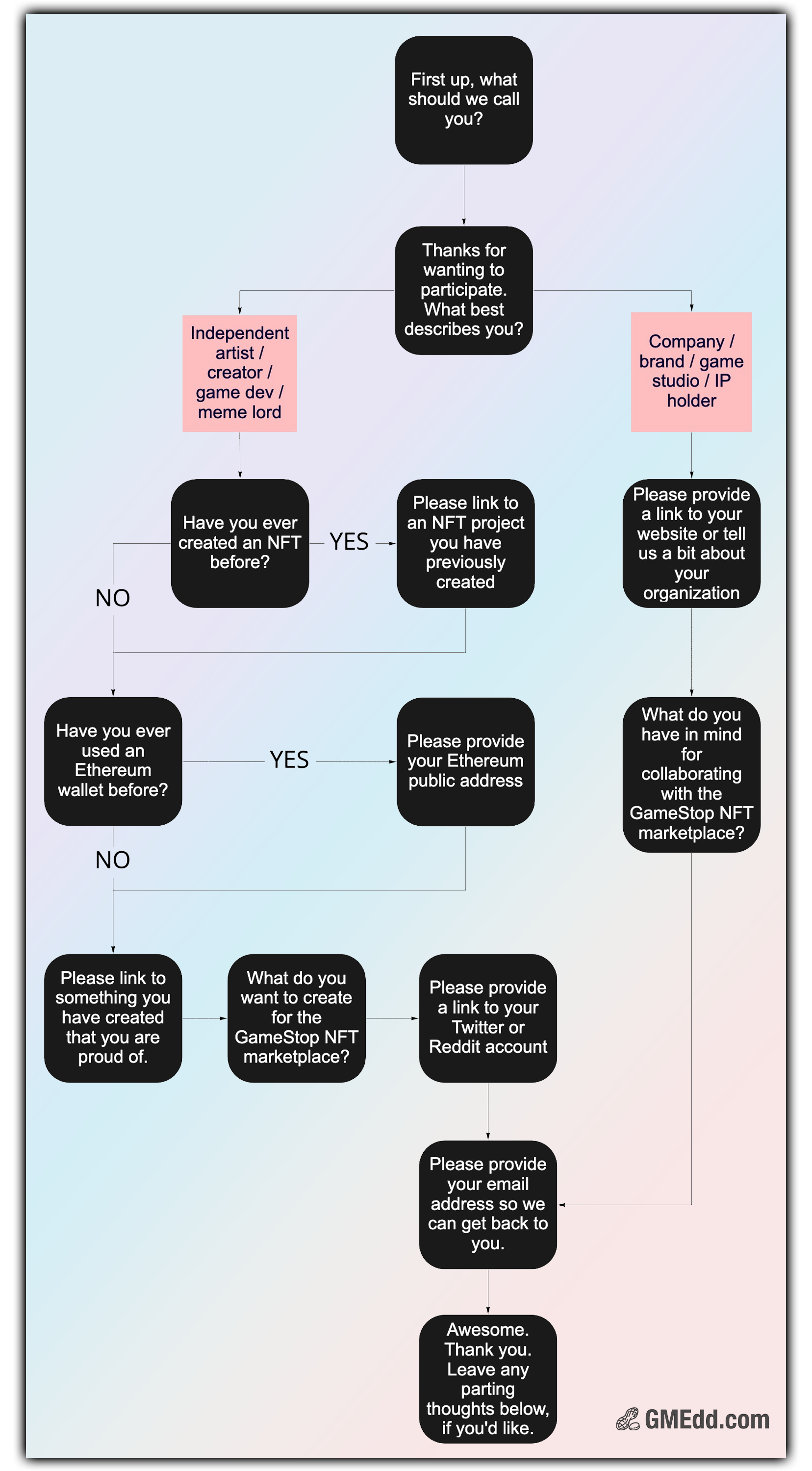

In an increasing mania, GameStop began recruiting individuals for an “NFTeam” upon establishing NFT.GameStop.com, asking for exceptional engineers, designers, gamers, marketers, and community leaders to join the project.

It wasn’t long until speculative investors began pondering GameStop’s move into NFTs, and what the brick-and-mortar retailer was up to hiring blockchain engineers.

By October, GMEdd.com was confident enough to put all of the pieces together and publish the findings.

Loopring is the key

Loopring is aiming to leverage blockchain to become the leading user-facing financial services application in the world. Revolutionizing trading, investing, payments, ‘banking’, to become the gateway of choice for users to experience the parallel financial system of Ethereum — in all its glory and security.

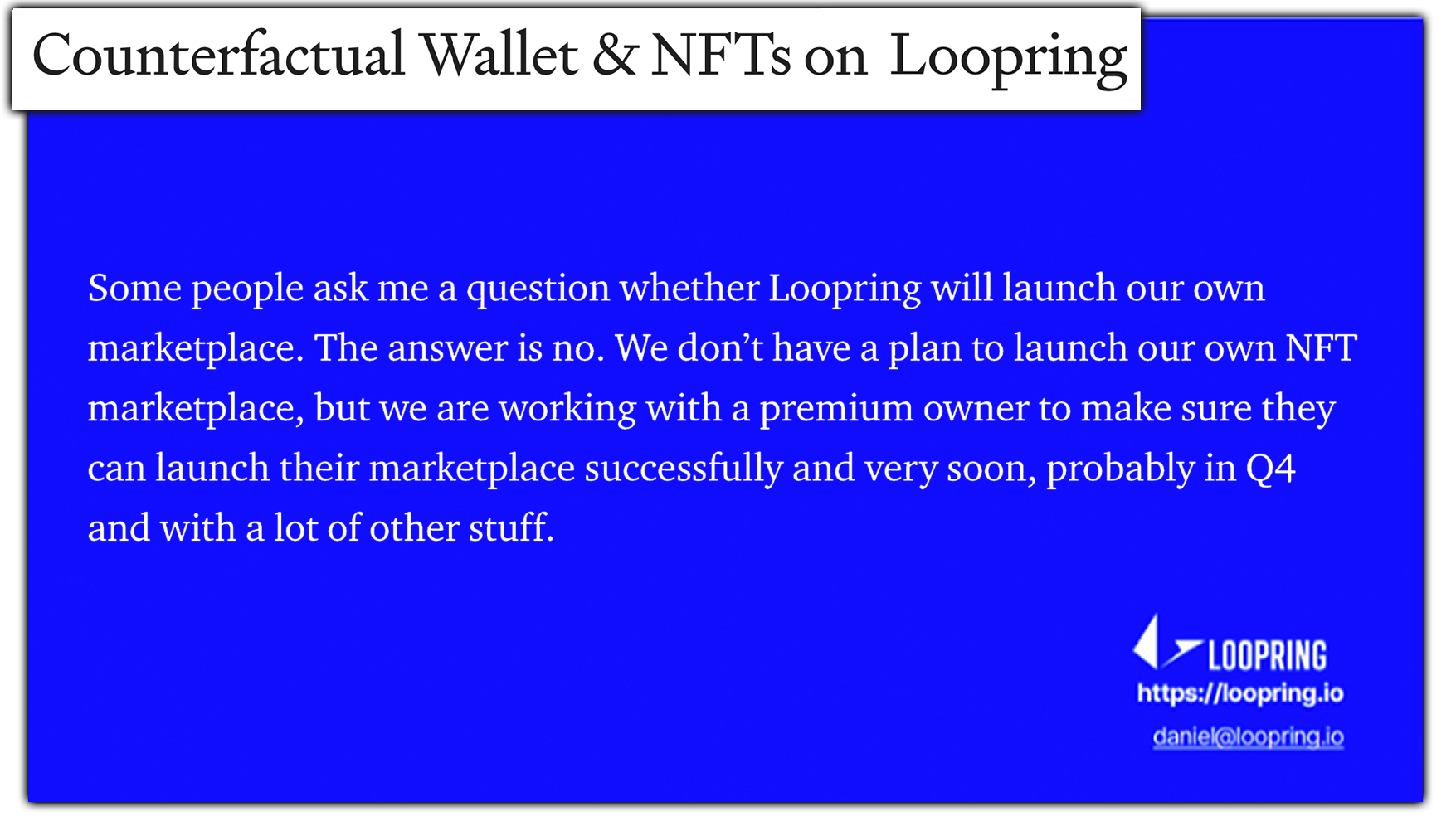

Loopring posted an interview titled, “Counterfactual Wallet & NFTs on Loopring” on Medium.

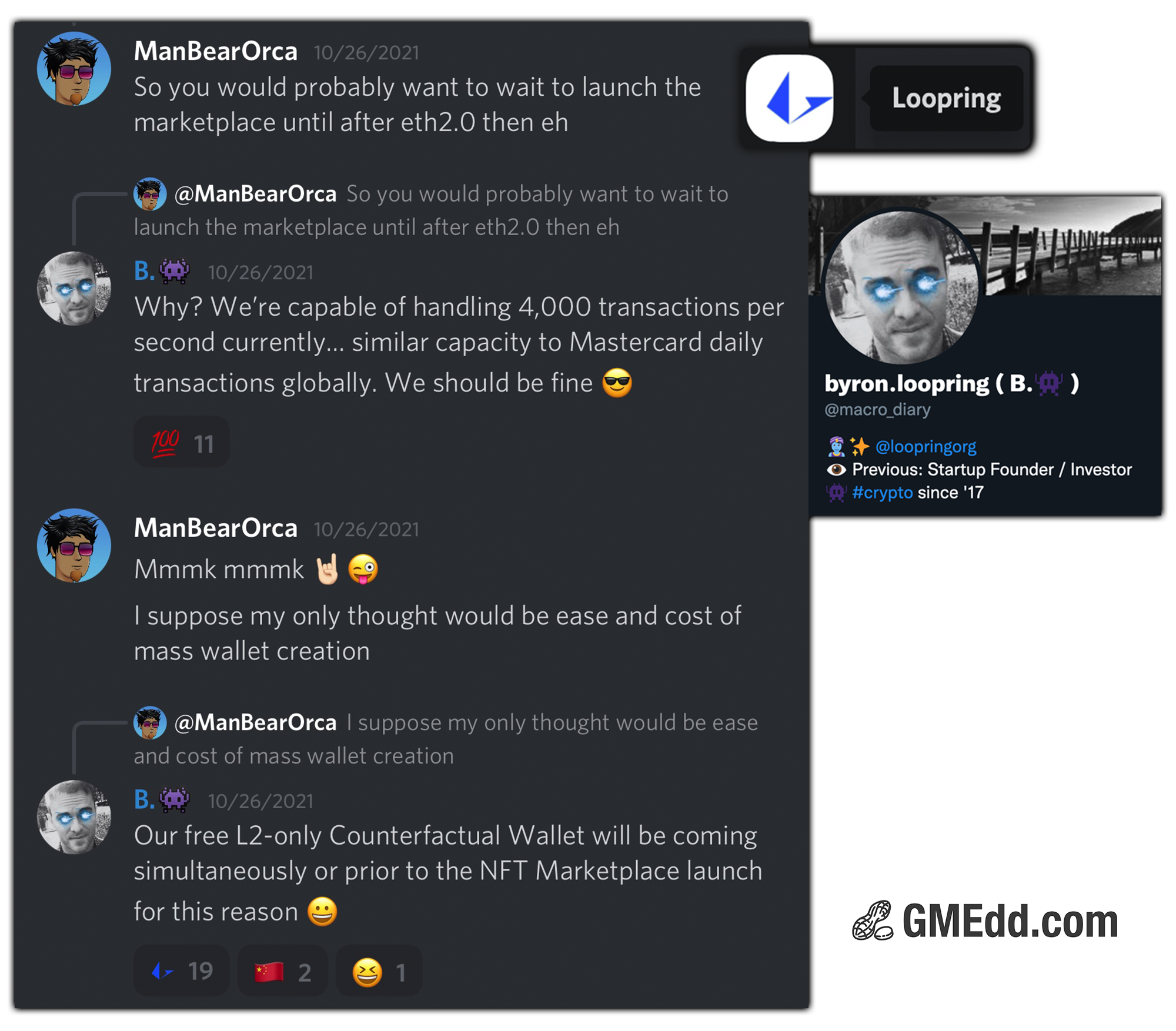

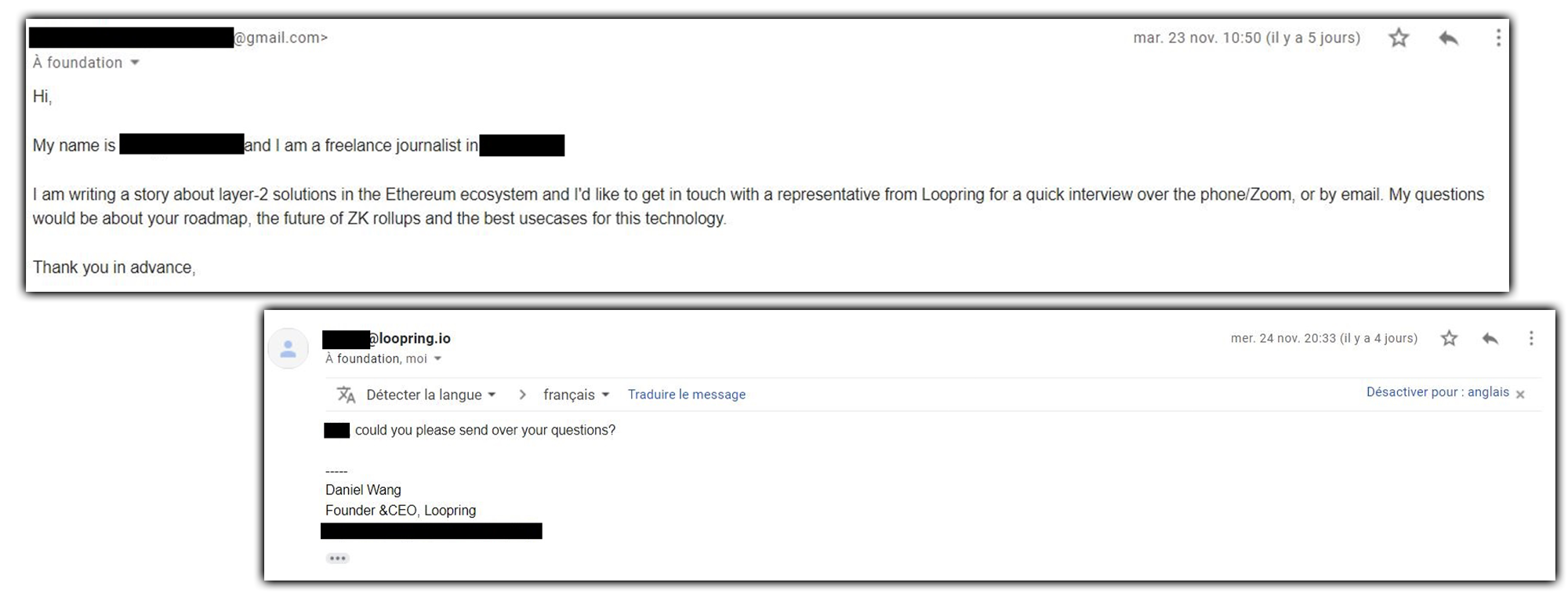

For months, the technology company had teased an NFT Marketplace launch with a “premium owner,” coming soon, and with glaring business ties and family ties, it seemed Loopring had the technology that GameStop would utilize to bridge traditional e-commerce and blockchain, and engineer the revolution of gaming.

Read more on the clues in Clues Point Towards GameStop Launching NFT Marketplace with Leading Crypto Technology Company Loopring

Just days later, with the clues published and the theory gaining traction, GameStop bluntly requested NFT marketplace experience in a job posting, alongside blockchain gaming.

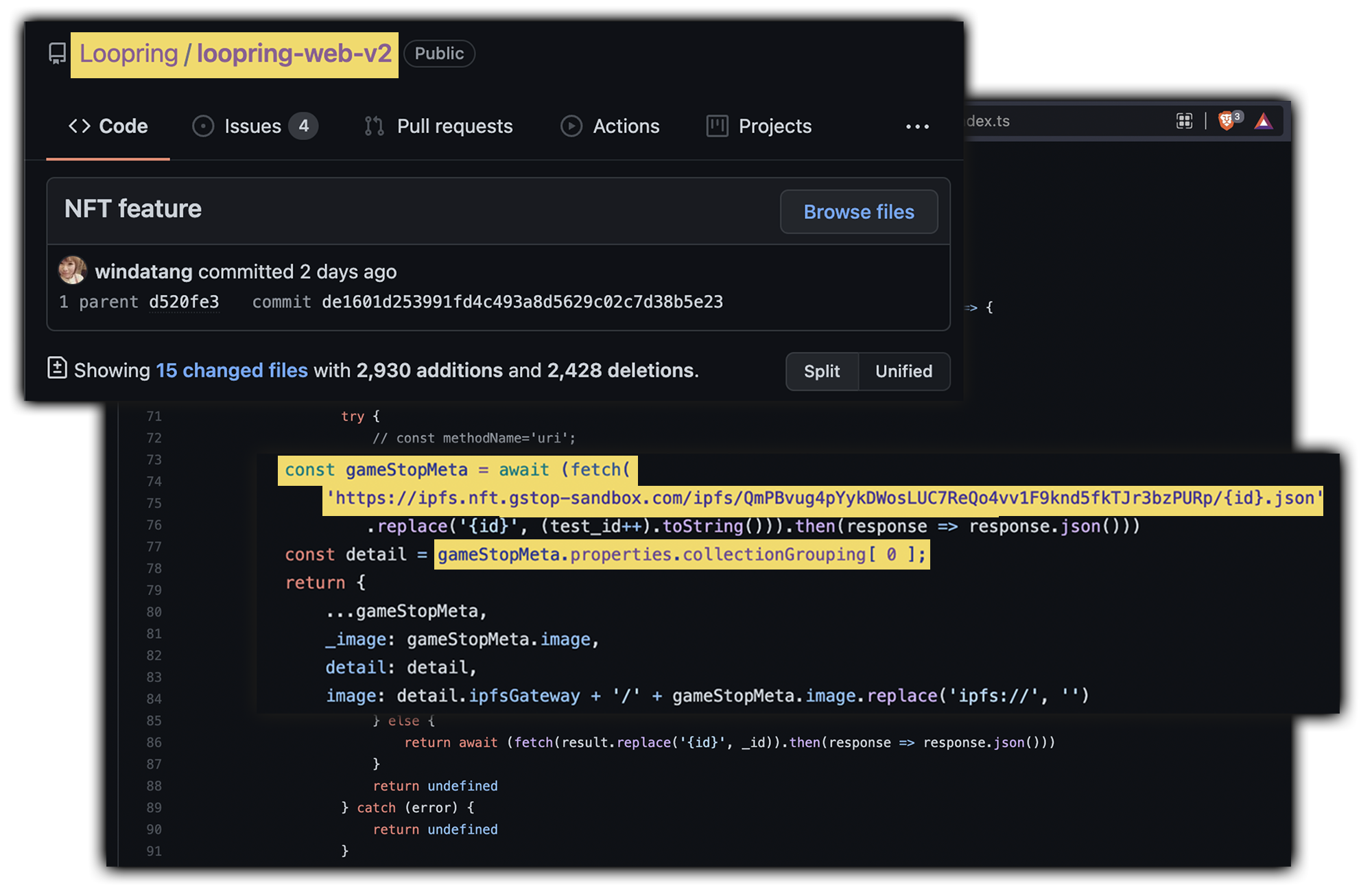

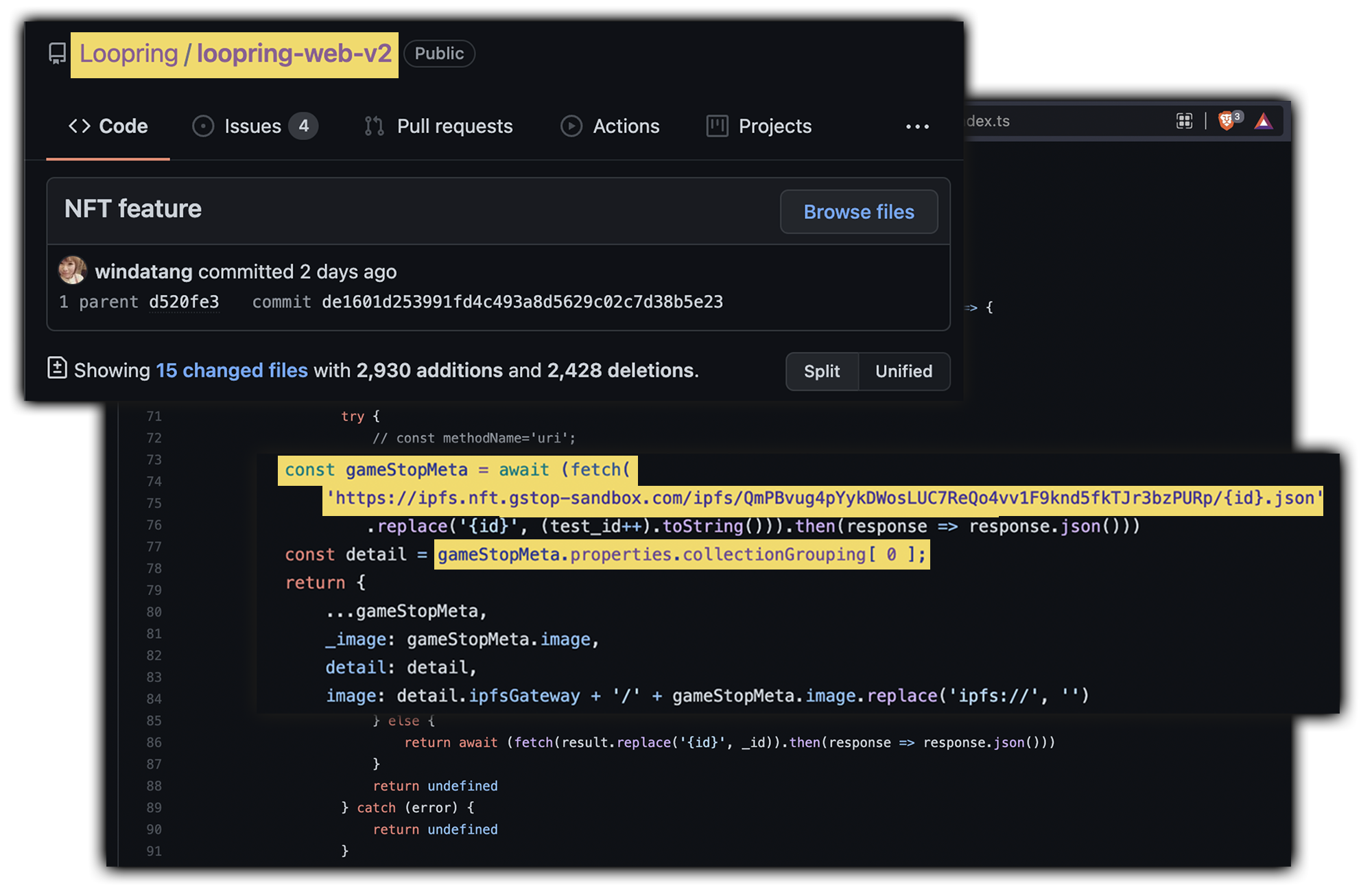

The very next day, GMEdd.com noticed updates pushed to Loopring’s public GitHub repository containing code referring to GameStop, confirming the highly speculated partnership.

Loopring’s ‘NFT feature’ code revealed several references to GameStop.

Loopring had also announced that the NFT marketplace will feature gas-free, instant transactions, eliminating a high drop-off point in the conversion tunnel and a major impediment to mass-adoption.

At this point, with over 250 fresh tech-experienced hires, it has become irrefutable that GameStop is on the brink of transforming into a technology company, and now it’s just a matter of valuation.

What’s it worth?

It could be argued GameStop’s NFT marketplace has a greater chance of success because the established gaming brand already has a customer base of early adopters, including 55 million PowerUp Rewards members and an enthusiastic base of retail investors eager to adopt the platform.

Through a successful NFT marketplace launch, GameStop has the potential to generate millions of high-value additional revenue per year, cementing itself in the technology sector and forcing Wall Street to stop evaluating the company as a brick-and-mortar retailer and start implementing tech multiples.

Sources: Ryan Cohen in Entrepreneur, TechCrunch, Roaring Kitty on YouTube, SEC 13D Filing, GameStop Careers, Chewy.com Archive, GameStop News Release, Loopring on Medium, GitHub Archive, Wall Street Journal, HBR

Join GMEdd.com’s Official Discord Server to chat about this article, GameStop’s transformation, and more.