We crowdsource Our research

GMEdd.com was founded by retail investors to immortalize the community’s research and high-quality due diligence on the GameStop fundamental investment thesis

Click Here to join the discussion

Do Your Own Due Diligence

Month: July 2022

GMEdd.com was founded by retail investors to immortalize the community’s research and high-quality due diligence on the GameStop fundamental investment thesis

Do Your Own Due Diligence

The GameStop NFT launch strategy was unlike competition, and it worked to bring over $4,000,000 in volume in just three days. Here’s how.

In April of 2021, GameStop Chief Technology Officer Matt Francis stated the company’s transformation will be studied in every business school for the next decade.

We’re witnessing this transformation in real-time. Why wait to study? Let’s dive into GameStop NFT’s marketplace launch strategy. It’s both counter-intuitive and simple.

GameStop’s strategy is involves building in silence and putting the community first. Stay tuned for exclusive insights from top GameStop NFT marketplace launch creators Ordinary Adam and Cyber Crew.

GameStop dropped their beta NFT Marketplace without warning on 7/11 at 4:20pm EST.

In the crypto market, enthusiasts are used to new ventures spending weeks promoting and driving as much hype as possible prior to a launch.

But GameStop didn’t hype the marketplace in advance, and their official beta launch announcement was only a single paragraph press release. The gaming retailer didn’t even tweet about it until 20 hours later.

Let’s cruise – https://t.co/zhNbY36C2x is here!

GameStop NFT has launched for gamers, creators, collectors, and community members to buy, sell, trade, and create NFTs (“Non-Fungible Tokens”)! pic.twitter.com/KDyGkn6wNQ

— GameStopNFT (@GameStopNFT) July 12, 2022

The discreet release of the GameStop NFT launch was intentional. Even today, everyday people outside of retail investing circles have little knowledge that the “left for dead retailer,” launched something new, as stated by Chairman Ryan Cohen.

This is a completely different approach from how Coinbase, the leading centralized crypto exchange, launched their NFT Marketplace with mass marketing.

Why would GameStop do this?

Let’s first dive deeper into Coinbase’s NFT marketing strategy to understand why GameStop NFT took a different approach.

Coinbase started promoting its NFT marketplace back in October 2021, when its VP of Product published a medium article encouraging people to join a waitlist.

Coinbase had decided to build in the open, providing updates and previews along the way.

Coinbase NFT promoted their waitlist on October 12, 2021.

Four months later, in February 2022, Coinbase had over 3.7 million people on its waitlist. The crypto exchange also had a viral superbowl commercial which increased app downloads by 279%.

Coinbase NFT’s success seemed inevitable. If they just convert 2 to 5% of those 3.7 million people into users, the crypto exchange would have 74,000 to 185,000 users on day one, beating OpenSea’s daily users of 40,000 to 50,000 immediately.

At the time, the NFT-sphere on Twitter couldn’t stop talking about how Coinbase NFT’s launch would pump their bags and make them rich by onboarding hundreds of thousands of new users that’ll want to buy their NFTs.

Tweet from 570kyle on July 12, 2022.

On April 20, 2022, the beta version of Coinbase NFT finally launched, but only a select few that Coinbase invited via email could use the marketplace.

Coinbase claimed the marketplace was being rolled out in the order of the waiting list, but suspicion rose over the platform’s gated entrance.

It appeared that big NFT influencers were given priority access to beta test the Coinbase NFT marketplace.

Two weeks later, when Coinbase NFT was out of beta and available for everyone, Coinbase only had 150 transactions on its first official day. Few expected this massive failure, but it was dead on arrival.

Coinbase NFT’s botched launch demonstrates failure to captivate an audience. Coinbase had the customers, but it didn’t have a community. The exchange had millions of existing crypto customers, but lacked a tight-knit community strong enough to support new business ventures.

GameStop Board Member Larry Cheng, who was also the first investor in Chairman Ryan Cohen’s Chewy, understands that communities are the key value drivers for businesses.

The divide in value between businesses that just have customers and businesses that have community + customers is becoming more stark. To many, community has historically been a nice-to-have. In the future, community will be the key value driver of the entire business.

— Larry Cheng (@larryvc) February 22, 2022

Communities are created by people; so a genuine community isn’t easy to build. It’s about those with similar interests building relationships amongst one another and fostering a sense of belonging.

GameStop didn’t need marketing for their NFT Marketplace because their community of individual investors is doing it for them.

When GameStop first published their NFT landing page, the gaming retailer didn’t announce anything. Still, retail investors quickly noticed the website contained a form where artists can request to be a creator on the GameStop NFT Marketplace.

GMEdd.com’s 12/28/2021 article ‘GameStop Confirms NFT Marketplace, Calls on Creators to Request Minting Access Now.’

In an interview with GMEdd.com, Ordinary Adam, a top GameStop NFT Launch Creator with $735,849 volume in one week, said he heard about the upcoming Marketplace thanks to the Reddit community and GMEdd.com.

“I had a lot of fun following the bread crumb trail and hints left around that it was happening on Loopring technology,” Ordinary Adam says. “I had applied to the GameStop marketplace after I was heavily encouraged by the community to do so, I honestly thought I wouldn’t get in.”

After Ordinary Adam received word that he was approved for the marketplace, he shared that his experience with the GameStop blockchain team was “unbelievably positive.”

“Admittedly I was nervous during our first conversation, but the moment we started chatting it felt like I was talking to old friends,” Ordinary Adam says. “The team is very receptive to feedback and really just wants to create the best experience for everybody. I couldn’t gush more about the team they’ve put together, just great people all around.”

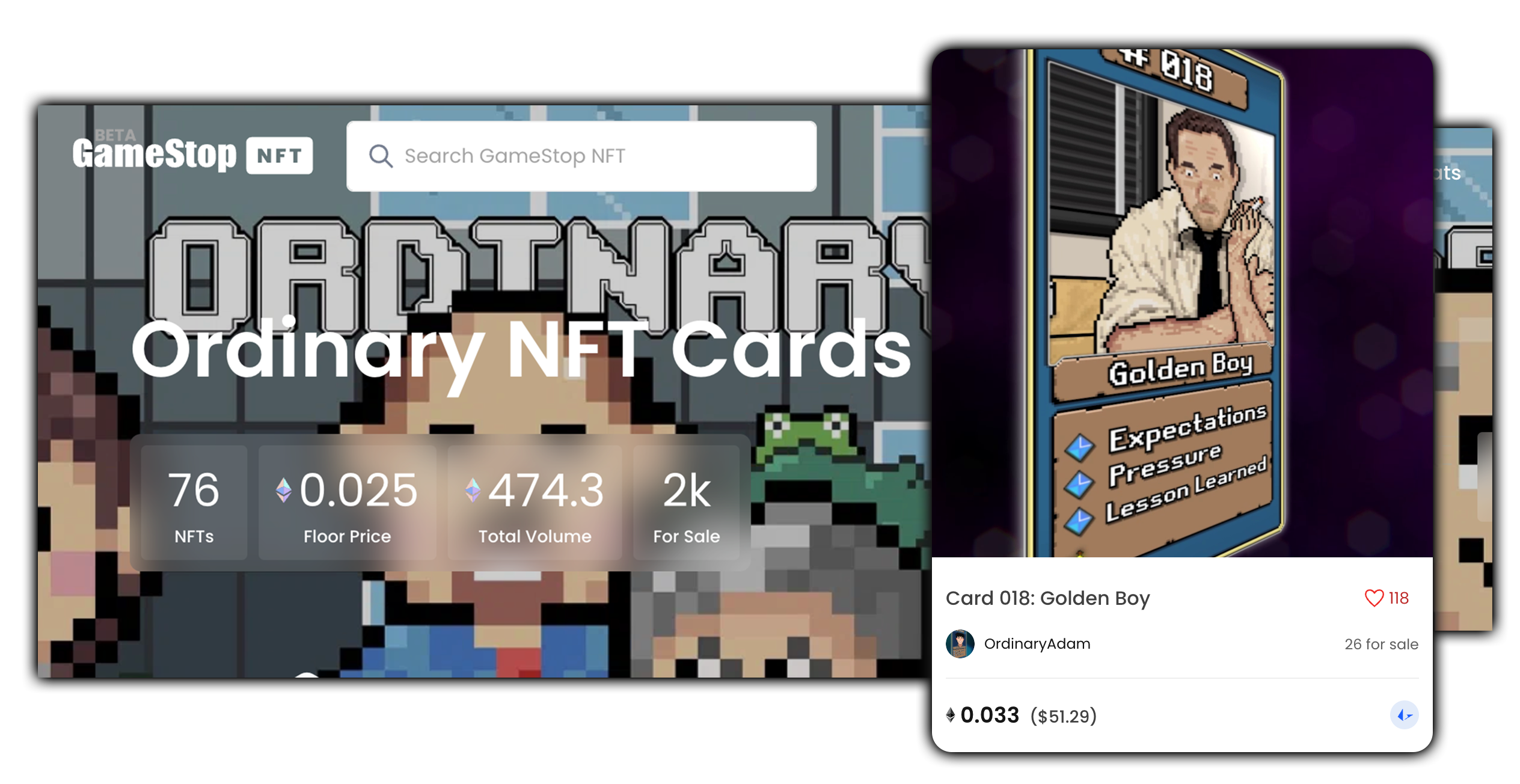

Since the launch of the Marketplace, Ordinary Adam has sold out of his collection of animated trading cards full of inside jokes referencing GameStop’s retail investor community.

Ordinary NFT Cards on GameStop NFT.

GameStop’s fanbase formed slowly and gradually, starting with a small group of individual retail investors who saw value in the company. When the buy button was turned off in late January of 2021 and the stock price dropped, investors were outraged and interest grew.

With various GameStop discussions forming on Reddit, Discord, and Twitter, GameStop began embracing their newfound fame.

The company formed a social media response team, SMRT, which would both help customers with order issues and engage with the community. The brand also started selling GameStop hoodies with small rockets on them as a subtle nod to the stock “going to the moon.”

GameStop NFT developers are in on the fun as well, as the team hid a “secret.txt” file in the marketplace. When the community discovered it, it was quickly decoded and a secret message saying, “Power to the Puzzlers” was revealed.

When users enter the Konami code (↑↑↓↓←→←→BA) on the commemorative GameStop NFT arcade machine, a rocket ship and a skull that reads, ‘POWER TO THE PUZZLERS’ appears.https://t.co/TG9xnQWDwu pic.twitter.com/LL0bFrKpQF

— GMEdd.com (@GMEdd) July 12, 2022

GameStop knows their fanbase loves to decode and investigate. Through hidden puzzles and easter eggs, the company directly engages with its community in a way that is authentic.

Back in October, when Coinbase was collecting emails, GameStop was building their marketplace in silence and dropping breadcrumbs that suggested the “left for dead retailer” was building something new.

Ryan Cohen’s tweet on July 11th, 2022.

Rather than spoon feeding the bigger picture to the community, GameStop helped the collective grow even stronger by giving them just enough hints to piece things together.

Even with NFT trading volume in the broader market down 66% in the last 3 months, the strong retail base brought GameStop’s marketplace to 45,000 transactions on the platform’s first day.

And in less than 48 hours, GameStop NFT trading volume surpassed Coinbase NFT’s lifetime trading volume.

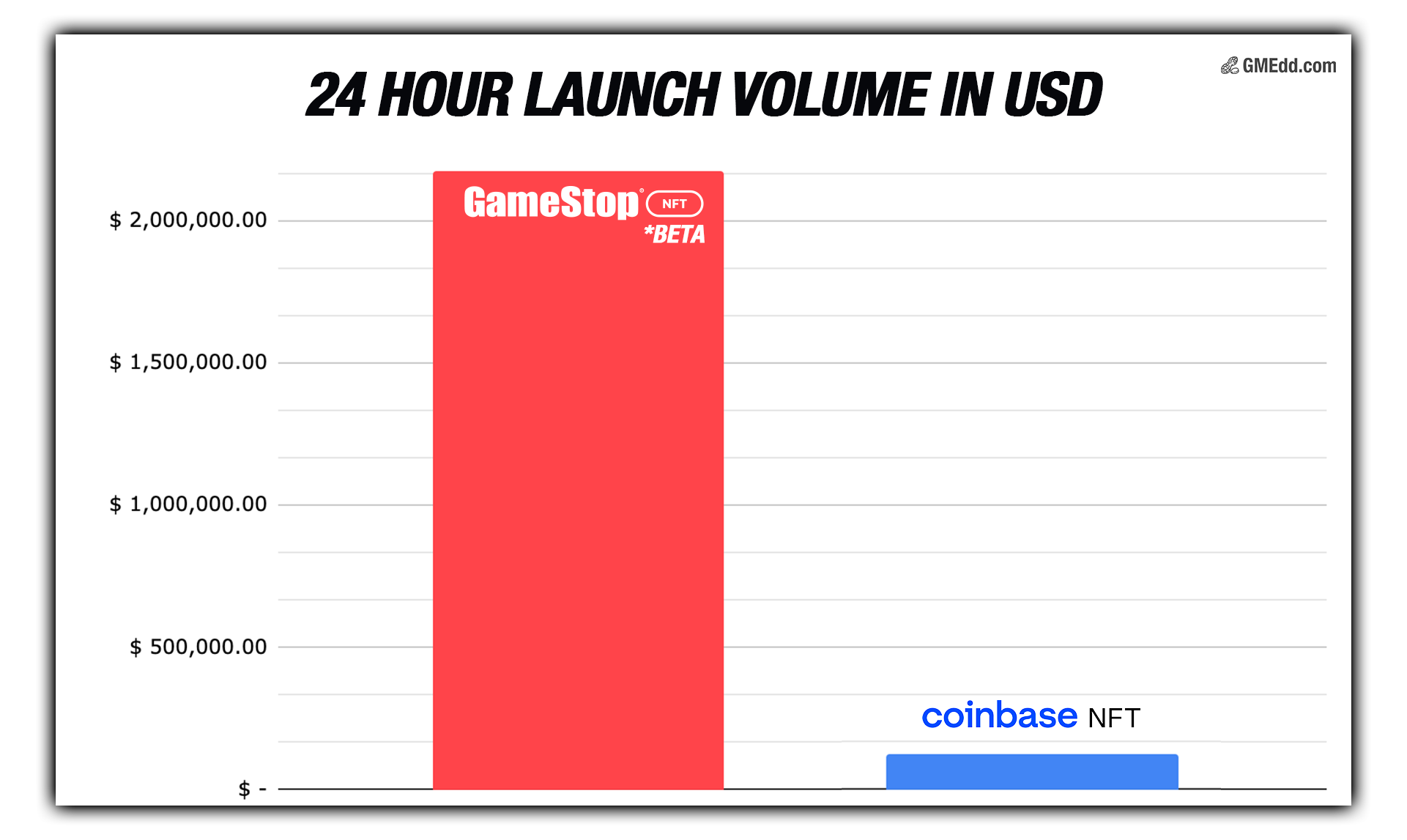

Within 24 hours of launching, the GameStop NFT Beta had just over $2,000,000 in volume. Coinbase NFT had just over $100,000 in volume within 24 hours of launching.

GameStop had underpromised and overdelivered, executing on one of Ryan Cohen’s core business beliefs.

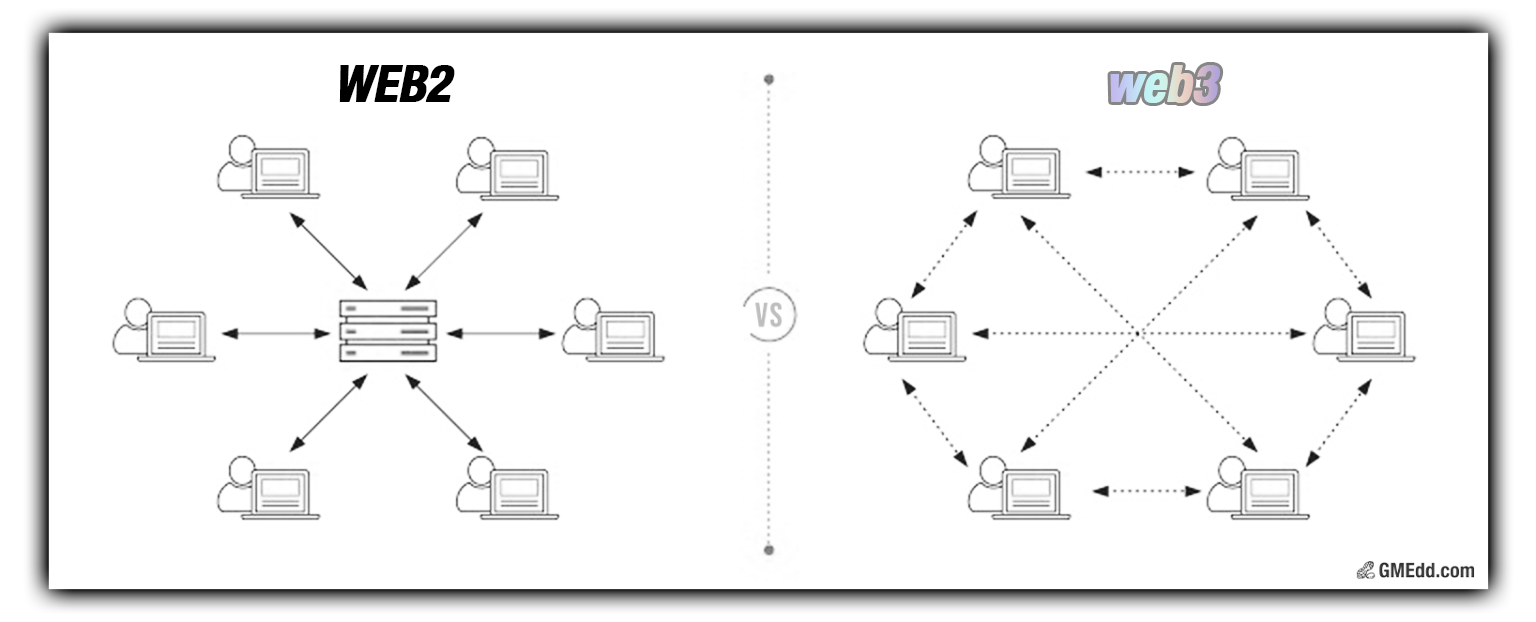

Leading NFT Marketplace OpenSea asserts that crypto-winter is here, and naysayers claim that non-fungible tokens are nothing more than tradable jpegs. What NFTs are now, though, is just the beginning of a larger shift to what web3 aspires to be: a decentralized internet.

The centralized internet vs the decentralized internet.

Today’s internet, often referred to as web2, is centralized. Tech companies control everyone’s data through a centrally owned server resulting in little transparency and accountability.

By owning everyone’s data, tech companies profit from selling information that shouldn’t be theirs to sell in the first place. Facebook might not charge you, but it is far from being free. Facebook has made you its product.

In web3, all user data is stored securely on decentralized blockchain networks such as Ethereum, enabling users to own their digital life while reducing vulnerability to attacks and censorship.

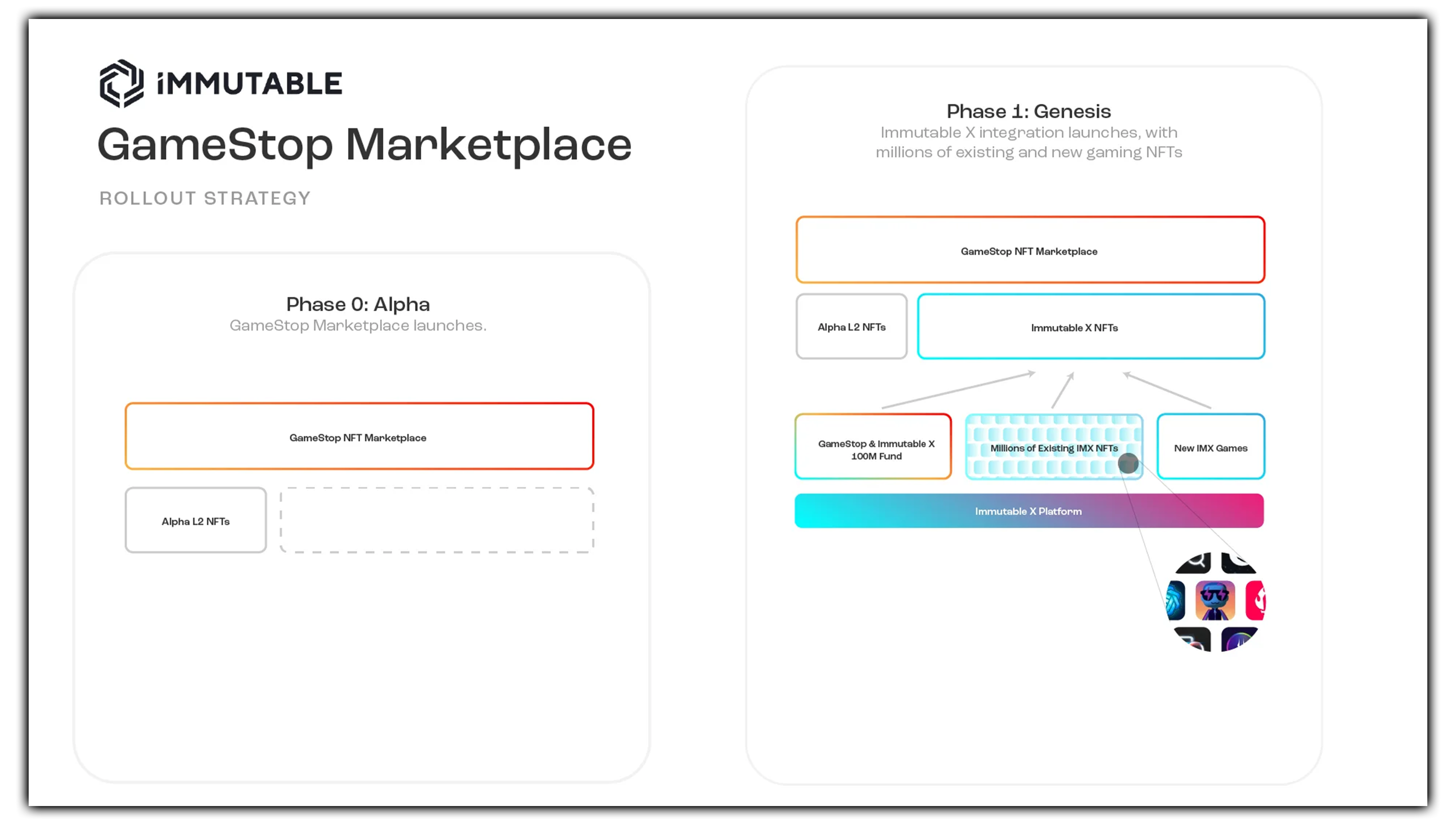

A fully-featured web3 is a long way out, and GameStop NFT partner Immutable claims that the Marketplace is similarly currently in phase zero.

Immutable’s GameStop Marketplace Rollout Strategy

According to Immutable, phase zero of GameStop NFT features a limited selection of art from the community, helping small creators sell their work without middlemen.

Creators can set a royalty fee, such as 5%, and continue to earn from each resale.

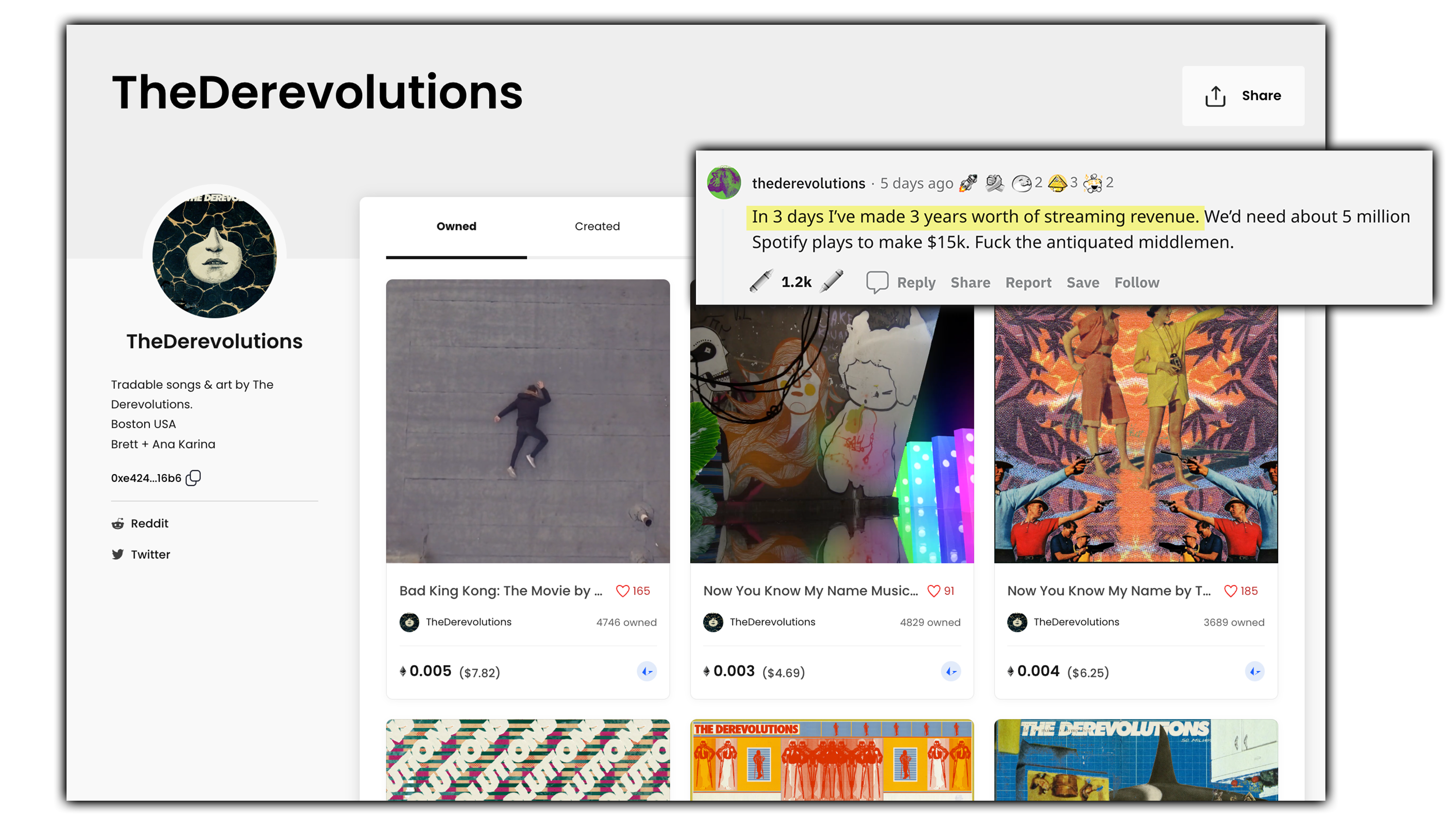

Brett and Ana Karina, two musicians from Boston who go by “The Derevolutions”, have been selling their music on the GameStop NFT Marketplace, and in 3 days the duo has made 3 years worth of Spotify streaming revenue.

The Derevolutions made a comment on Reddit, “fuck the antiquated middlemen.”

GameStop is now fulfilling their promise to bring power to the players with the NFT Marketplace.

Cybercrew, one of the top GameStop NFT launch creators who created the GameStop astronaut art, shares why NFTs are redefining ownership.

“Too many corporations just milk you with microtransactions. If they decide on a whim to remove access to a skin or item you purchased, it’s gone. No repercussions, no back and forth,” Cybercrew said.

Cybercrew, made up of Engwind and Brenden, collaborated with GameStop to create the astronaut that’s featured on the marketplace site.

But NFTs aren’t just about trading, and Cybercrew has big plans for their collections.

“As we build out the cross platform interoperability and show that you can kind of standardize equipment and avatars, more and more platforms will work on making it easy to access so it’s a win win.”

Cybercrew envisions a future where your NFT avatar is playable in many different games and virtual environments, and believes that the team’s innovation is going to “rock the foundation of video games and metaverses for years to come.”

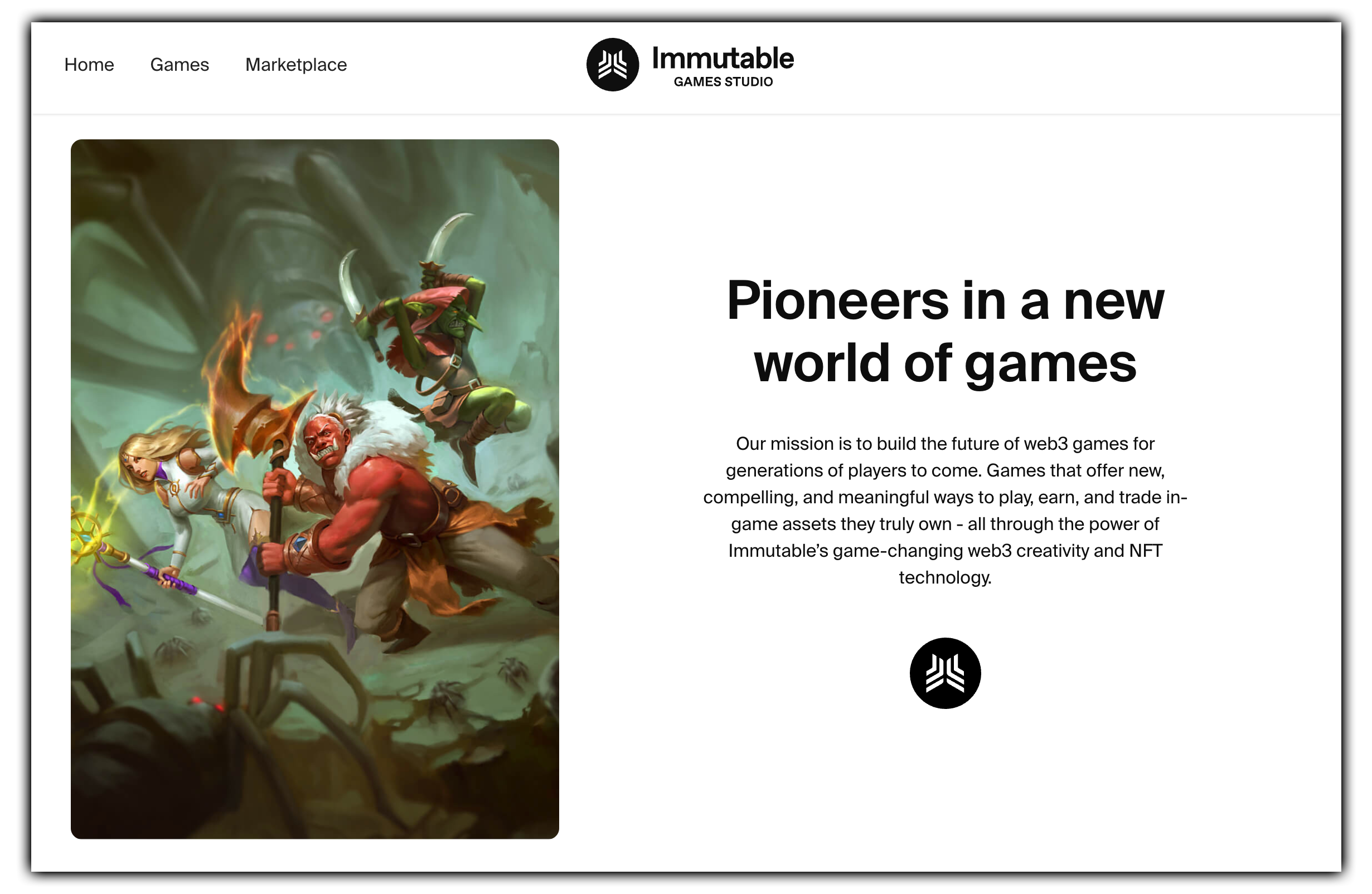

GameStop’s partnership with Immutable, an Australian blockchain company leading the industry with their NFT game development studio, seeks to bring AAA-quality blockchain games to the Marketplace.

Robbie Ferguson, co-founder of Immutable, said in a recent Twitter Space that large game studios will likely be the last to adopt NFTs.

Established publishers are watching the space closely, but have too much to risk, leaving mid-market and indie studios to be the pioneers perfecting the formula for web3 play-and-earn gaming.

The Immutable Games Studio Site

Ferguson believes that once millions of gamers have a taste of just one web3 title with more rewarding metrics than traditional games, established gaming studios will be forced to invest in web3 gaming.

Ultimately, NFTs in games shouldn’t be the selling point for web3 games. The web3 tech should be invisible to the players, and the games need to be fun enough to provide value for the players.

In web3, gaming studios will give up ownership of their in-game assets as it will align incentives with their audiences. If a publisher earns a small fee for each in-game transaction between players, then the incentive becomes to create the best games so that the player-driven economy grows. The more fun the game is, the more time players will spend growing that economy.

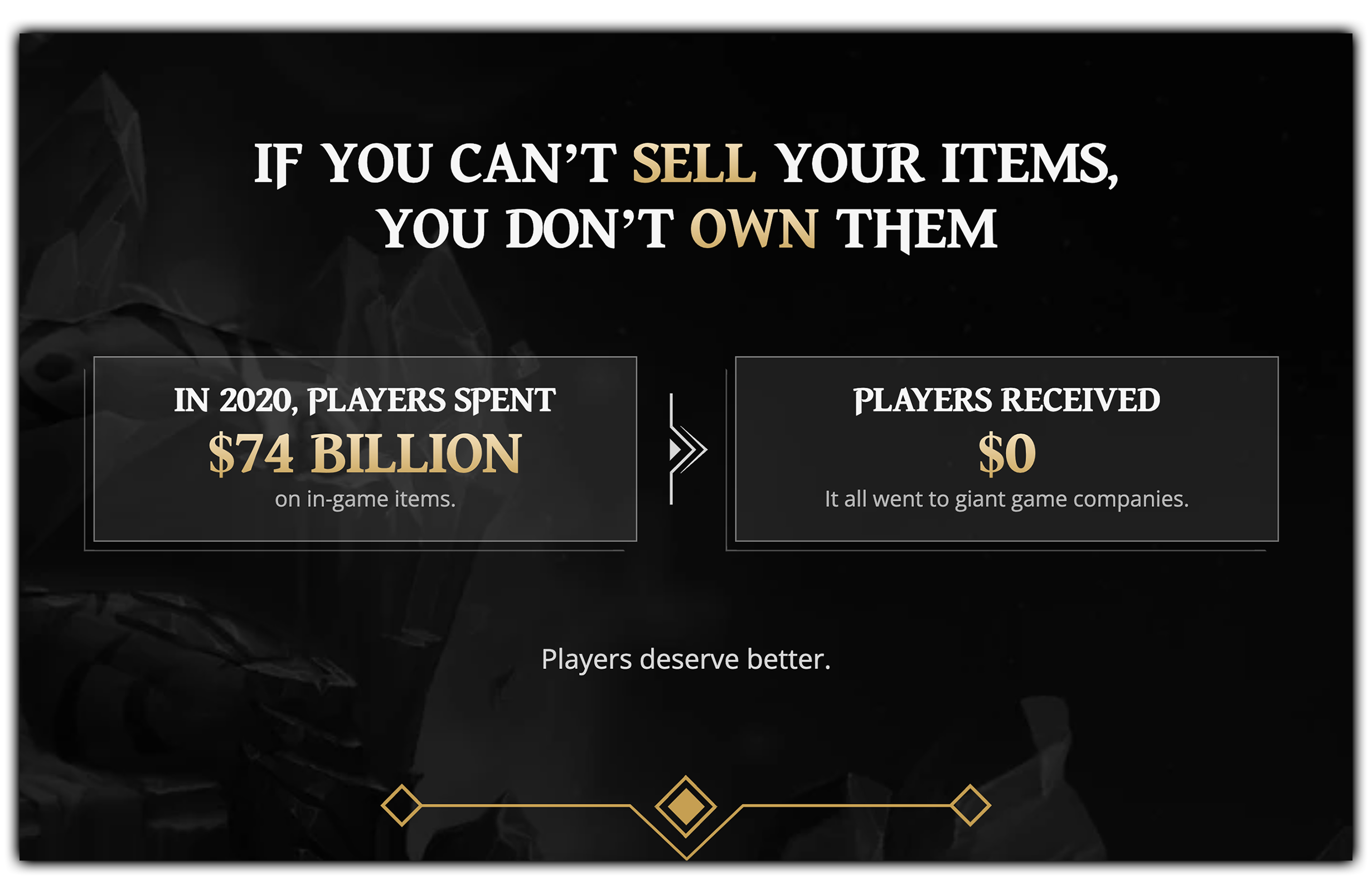

Gods Unchained states that “players deserve better.”

In 2020, gamers spent over $74 billion on in-game items, and they received $0 back. The money all went to the studios who are only incentivized by squeezing every last cent from its player base with DLCs or microtransactions.

Rather than rush out a marketplace, GameStop took the time to study one of the biggest obstacles plaguing NFT mass adoption: High gas fees.

For more on gas fees, read GMEdd.com’s GameStop’s NFT Marketplace Will Feature Gas-Free, Instant Transactions from October 28th.

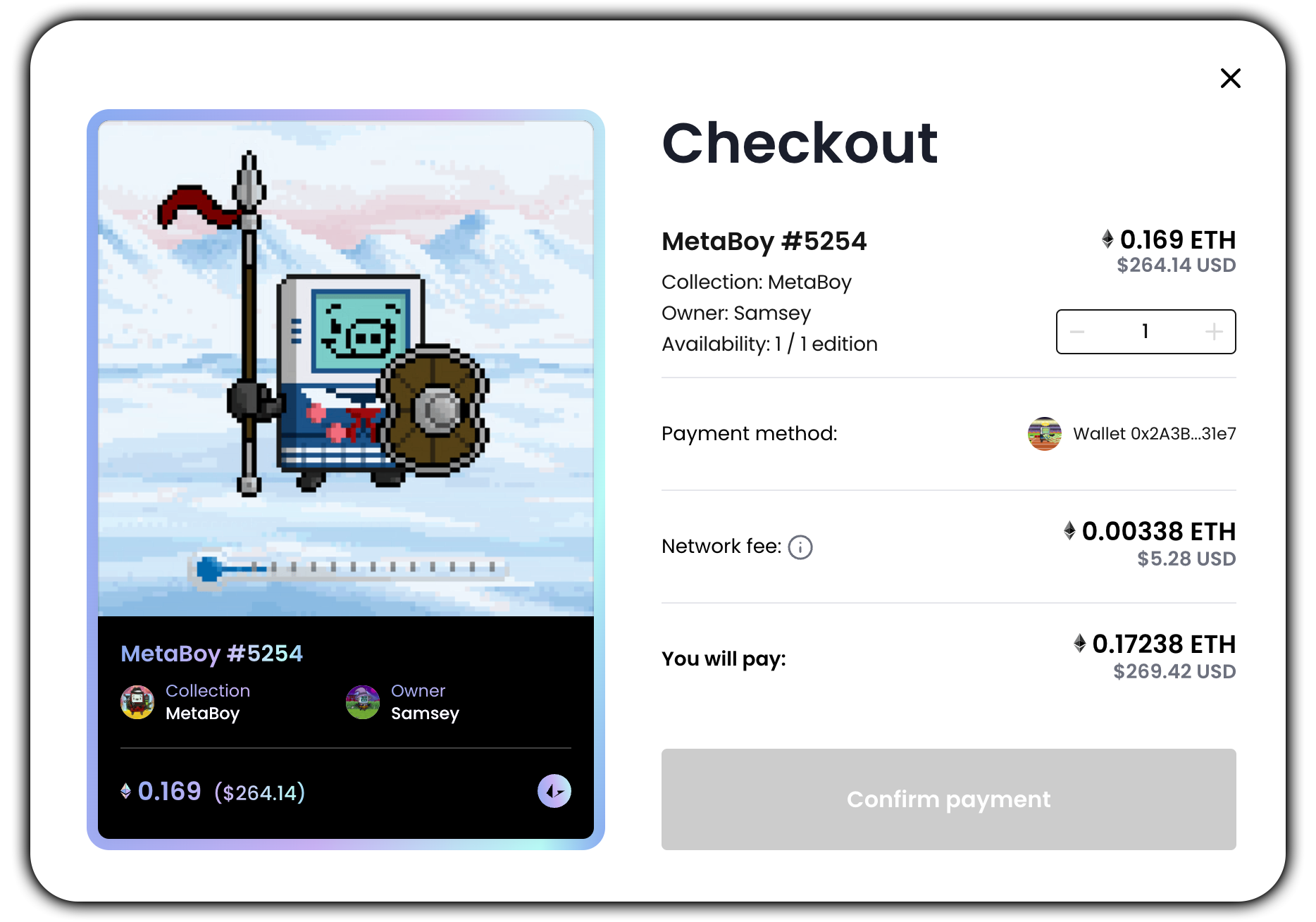

To eliminate gas, GameStop partnered with Loopring, an Ethereum layer-2 scaling protocol, to power the marketplace. As a result, GameStop’s NFT Marketplace is the only major marketplace with zero gas fees.

Instead, GameStop collects a 2.25% fee from sellers. Loopring collects a minimum 2% fee from buyers.

GameStop NFT’s Checkout Page

If GameStop is only collecting 2.25% in fees, then they only earned ~$90,000 in fees in the first 3 days – how does that help the business?

In web2, middlemen often take more profits than the artists themselves. These middlemen try to extract as much money as possible from artists rather than help them be successful in the long term.

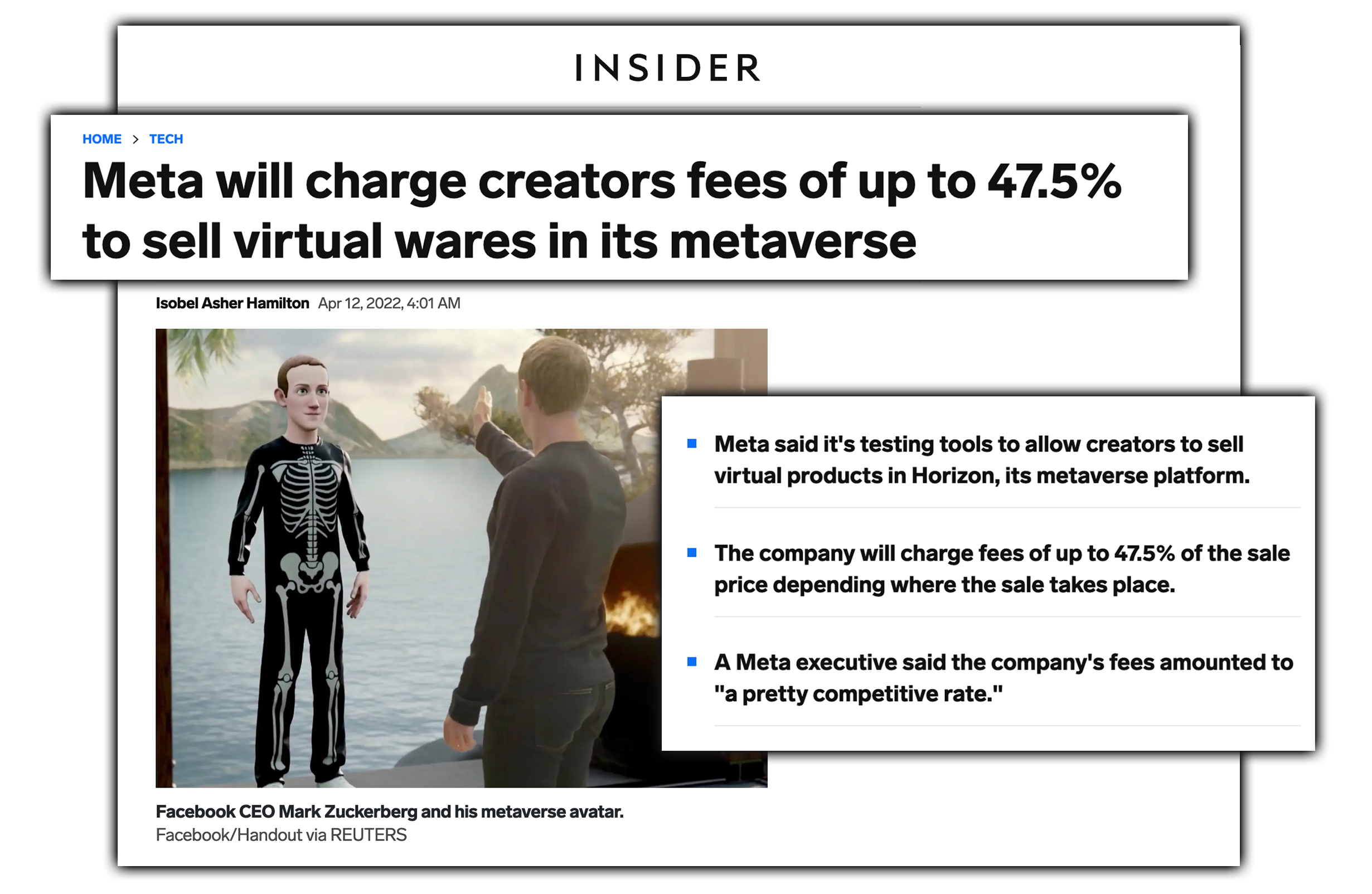

Mark Zuckerberg’s web2 giant Meta, for example, is trying to create a metaverse in which they charge creators up to 47.5% transaction fees.

Iosbel Asher Hamilton for Insider on April 12, 2022.

The public was justifiably outraged at this “pretty competitive rate,” demonstrating a need for a low-cost marketplace for creators and consumers to trade assets.

When the GameStop NFT collection “MetaBoy” sold out of 10,000 NFTs for $54 each, GameStop earned $6,750 while the MetaBoy creators earned $526,500. Now, MetaBoy is using these profits to build a GameStop NFT video game with MetaBoy sprites – this wouldn’t have been possible if GameStop took lofty fees.

The more successful the artists are, the more successful GameStop will be. It’s win-win. GameStop continues to onboard new artists everyday, which will grow the community and network effect overtime.

While the GameStop NFT Marketplace is in beta, the foundation for gas-free trading is here and the community is growing. Demand for web3 is revealed by the success of launch projects such as Ordinary Adam, Cyber Crew, and MetaBoy, and GameStop’s partnership with Immutable hopes to soon bring AAA-quality games to the blockchain.

joecomotion guest wrote this article exclusively for GMEdd, Toast contributed and edited.

Sources: GameStop Investor Relations, Coinbase Blog, Themetav3rse on Twitter, TechCrunch, Dappradar, Coinbase Blog, Gods Unchained, Frankenberg on Tableau

GameStop has announced the long-awaited debut of its online marketplace for non-fungible tokens (NFTs).

Video game retailer GameStop has spent the last year undergoing a tech-centric transformation, with a premium NFT marketplace being at the core of this transition. This newfound interest for the brick-and-mortar was initially revealed through job postings alluding to blockchain developments at the company dating back to April of 2021.

GMEdd.com first unearthed the existence of GameStop’s Official NFT project one month later, in May 2021, upon discovering a website that didn’t detail much besides a potential slogan for the project, and ever since then investors have speculated what GameStop NFT entails.

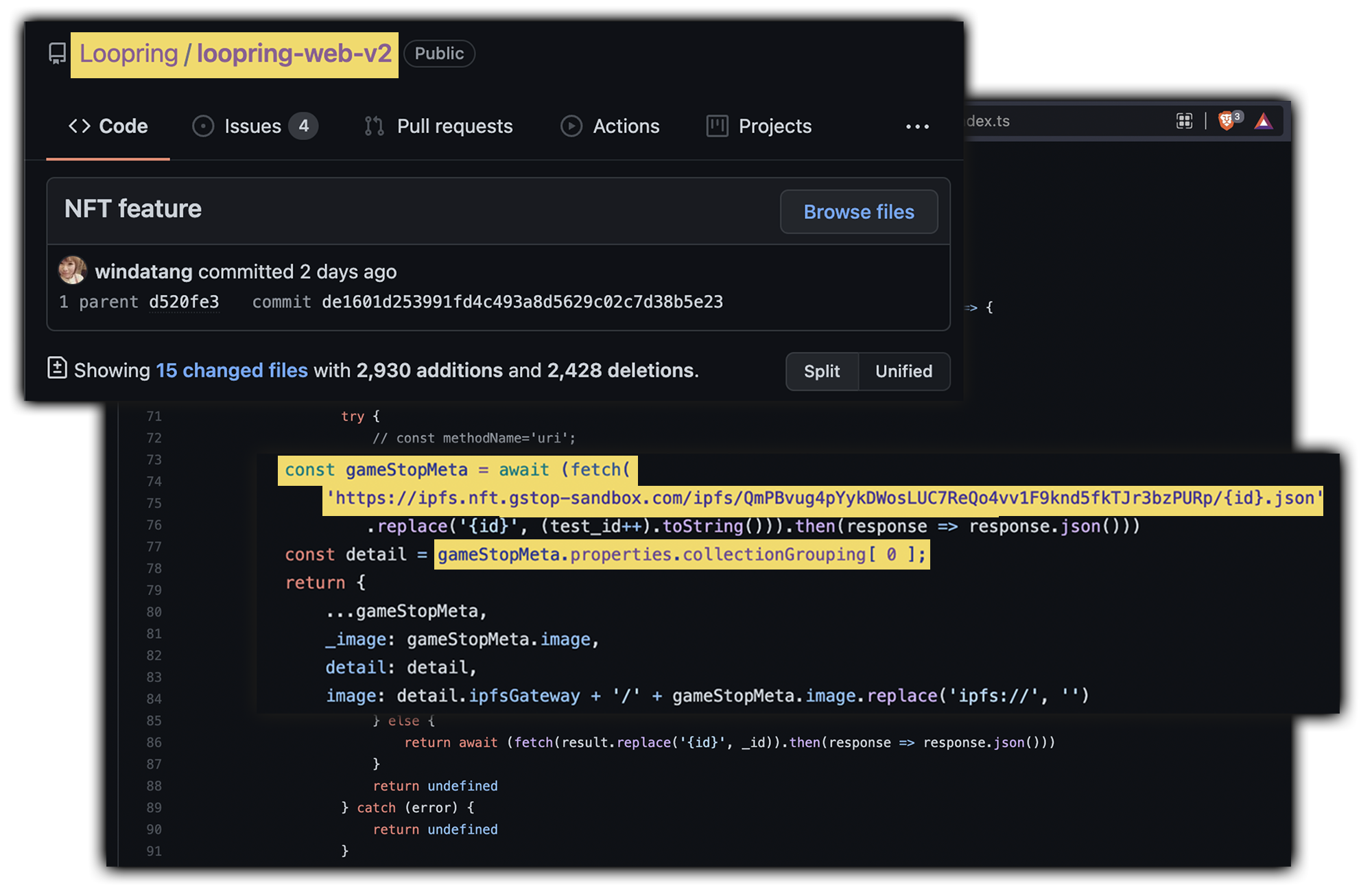

By October 27th, 2021, GMEdd.com published source code that revealed Loopring, an Ethereum Layer 2 Protocol, had been hard at work building GameStop an NFT Marketplace of their own.

Loopring’s GitHub Code from October 2021.

Prior to this, digital breadcrumbs had led us to that same point, detailing how Loopring’s technology could power a bridge of traditional e-commerce and blockchain and engineer the revolution of gaming.

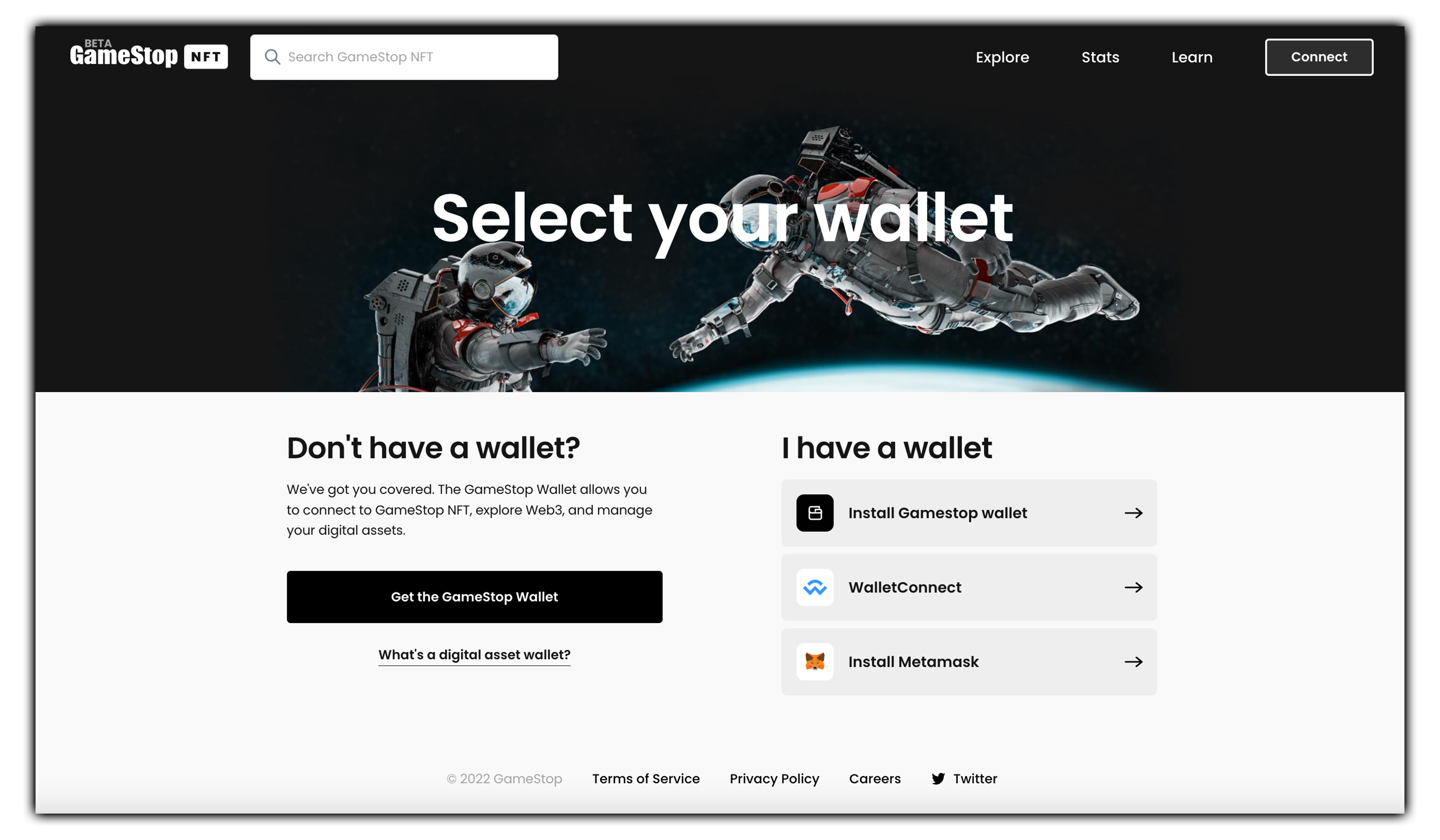

On Monday, GameStop launched a feature-packed NFT Marketplace. The platform, which is now open to the public for beta testing, allows users to connect their own digital asset wallets, including the recently launched GameStop Wallet, the company said in a press release.

GameStop NFT’s wallet selection page.

Users will now be able to buy, sell and trade NFTs of virtual goods with near-zero fees. Over time, the marketplace will expand to offer other features such as Web3 gaming, GameStop said.

Since the GameStop Wallet and NFT Marketplace is still in beta, users might find performance issues or bugs which they can report to the blockchain team.

Creators can apply to sell their art on the NFT Marketplace by clicking the “create” button on the homepage. GameStop states the team typically replies to applicants within 2 weeks, and if not, creators can re-apply.

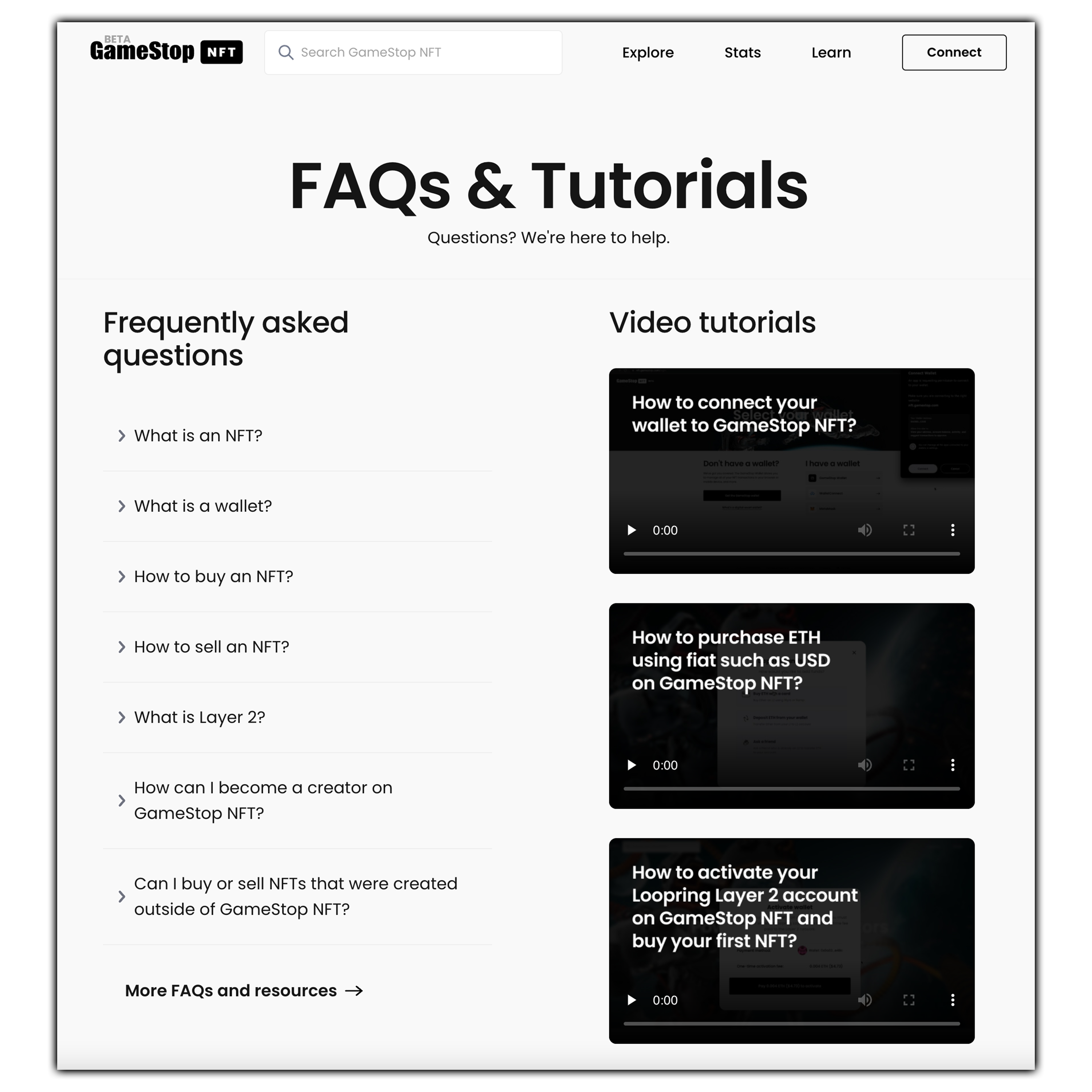

For beginners, the GameStop NFT marketplace has a detailed learn page with FAQs & video tutorials.

GameStop NFT’s Frequently Asked Questions Page

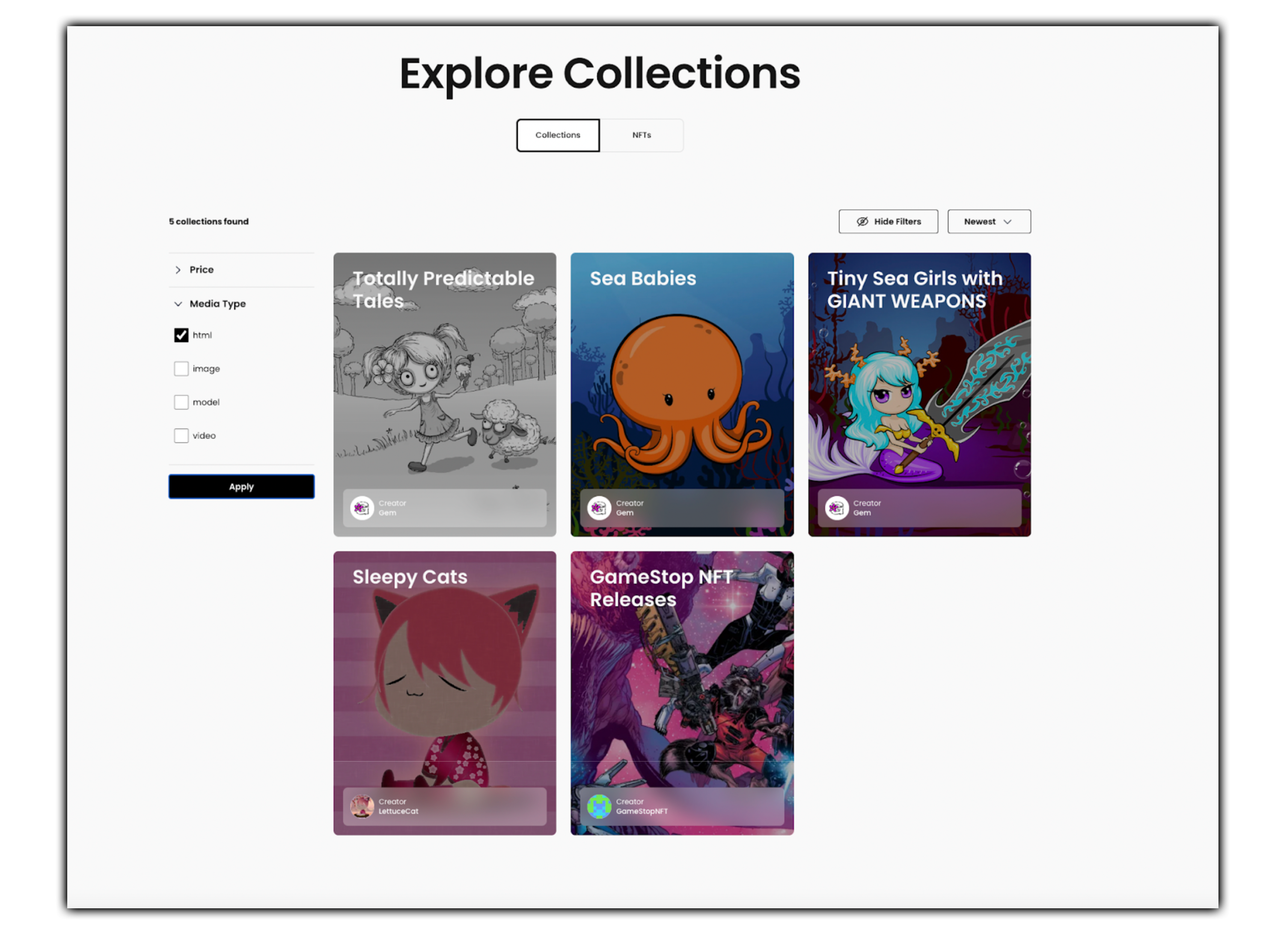

The marketplace currently features 239 NFT collections and 53.3k NFTs, which were manually approved in advance by GameStop’s blockchain department to ensure originality and quality.

When exploring the newly-released marketplace, users can filter by four NFT types: html, image, model, or video.

The html category includes NFTs that are interactive. For example, art that changes color or makes sounds when clicked, interactive story books, and mini-games.

GameStop NFT’s selection of interactive NFTs

The image category is what most NFTs are right now, featuring art that people can buy, sell, and trade, while supporting the creators.

The model category features 3D art and provides all the files you will need to use them with AR software, while the video category is more self-explanatory.

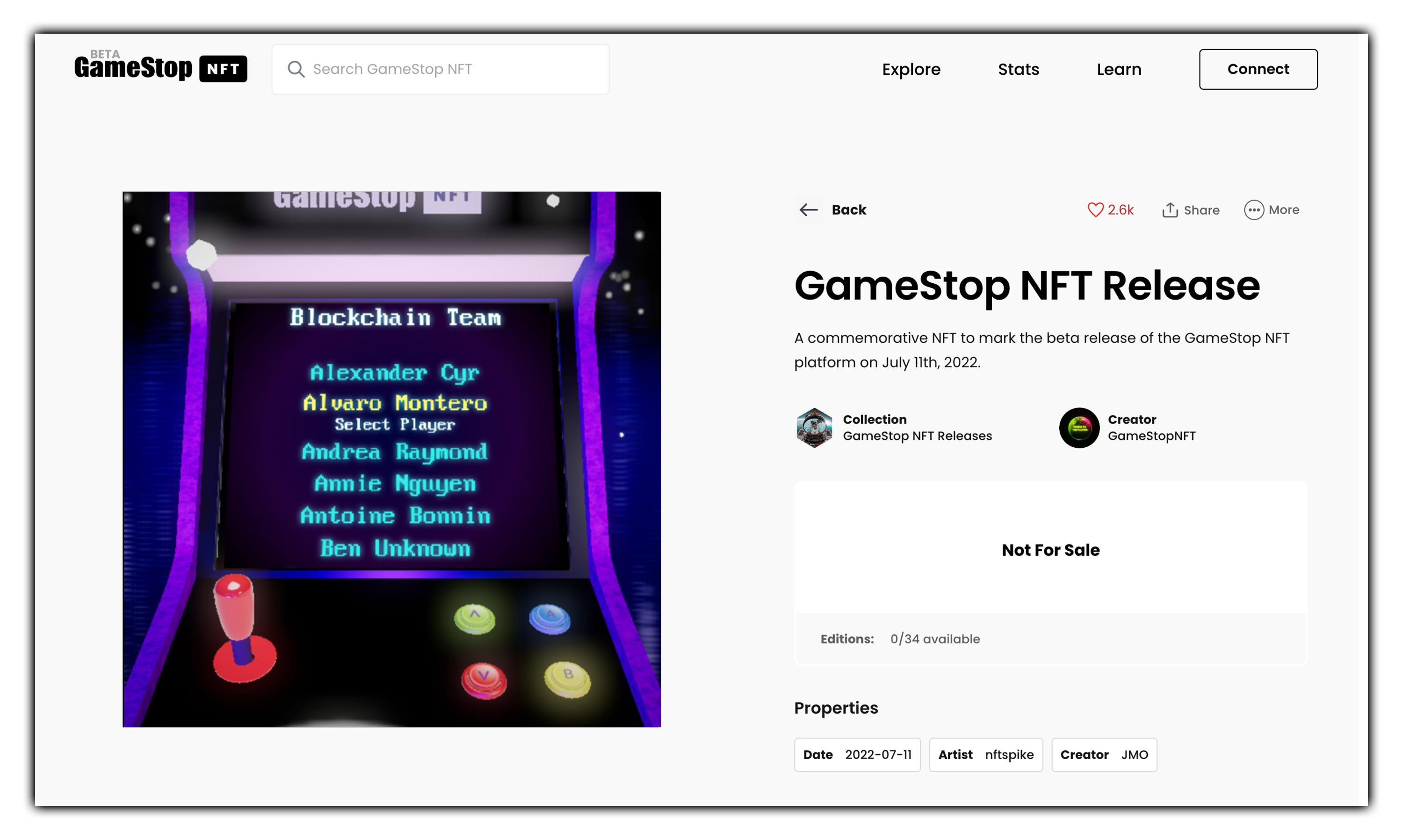

To celebrate the launch, GameStop NFT gave a commemorative NFT to the 34 blockchain team members designed by Spike.

GameStop NFT’s commemorative NFT to mark the beta release.

Within 24 hours of launching, GameStop NFT achieved over $1,500,000 in volume across 45,000 transactions.

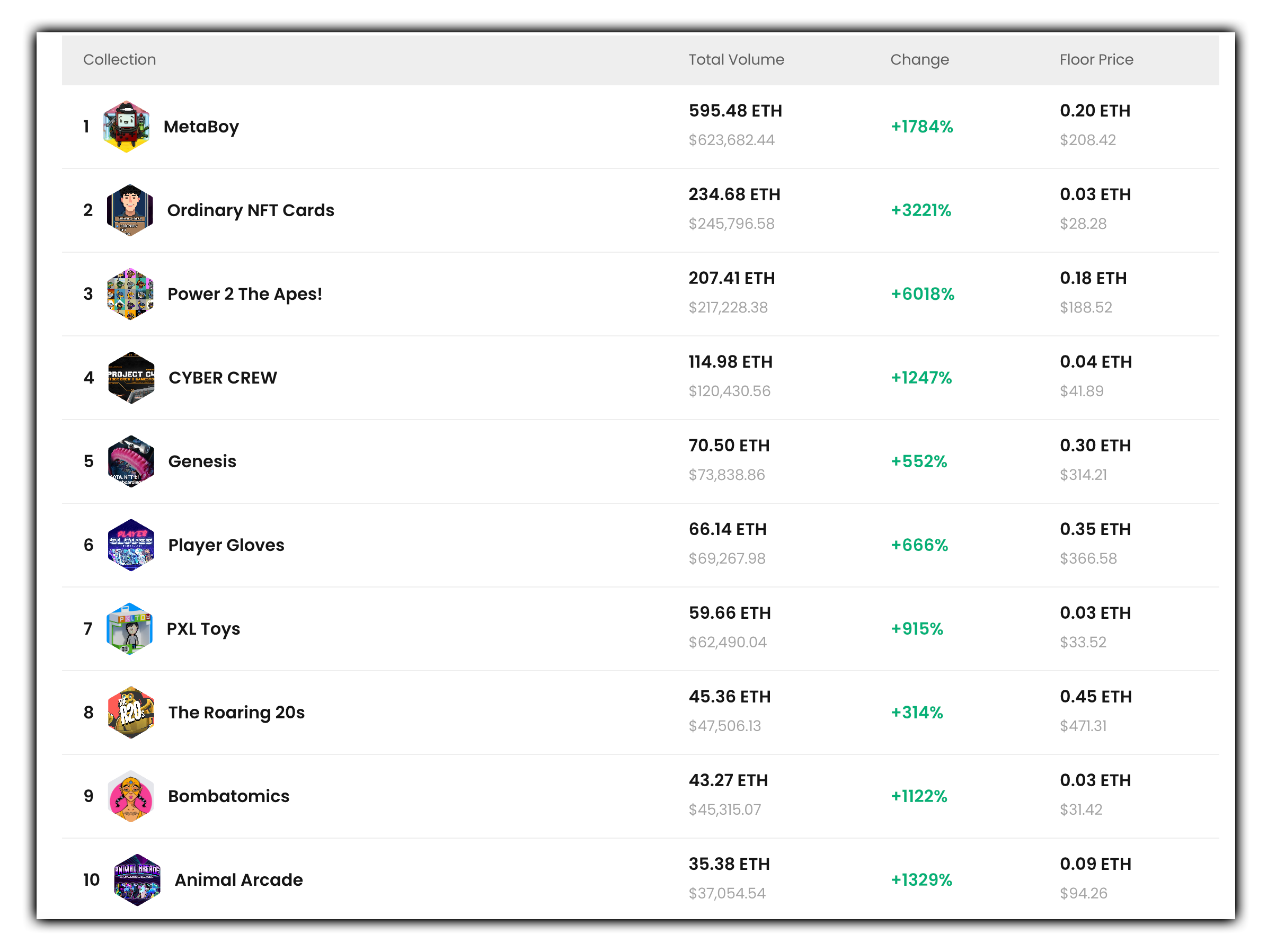

GameStop NFT’s top 10 collections are MetaBoy, Ordinary NFT Cards, Power 2 The Apes!, CYBER CREW, Genesis, Player Gloves, PXL Toys, The Roaring 20s, Bombatomics, and Animal Arcade.

GameStop NFT’s Stats Page

The most popular collection has been “MetaBoy,” a collection of 10,000 unique algorithmically generated characters that bring the love of gaming, pixel art and technology together.

Similar to trading cards, MetaBoys are pixel figures with differing traits that merge together to create unique avatars.

Since launch, MetaBoy has sold over $600,000 in volume, selling out of the initial primary price of ~$55. Now, MetaBoys are trading with a $250 floor as gamers and collectors alike join in on the craze.

GameStop NFT’s MetaBoy Page

GameStop NFT is finally here, and readers should explore the platform themselves to see what the wait has all been for.

With more integration to come, the GameStop blockchain group’s work is far from over, and GMEdd will continue to cover the latest news and research.

Sources: GameStop NFT

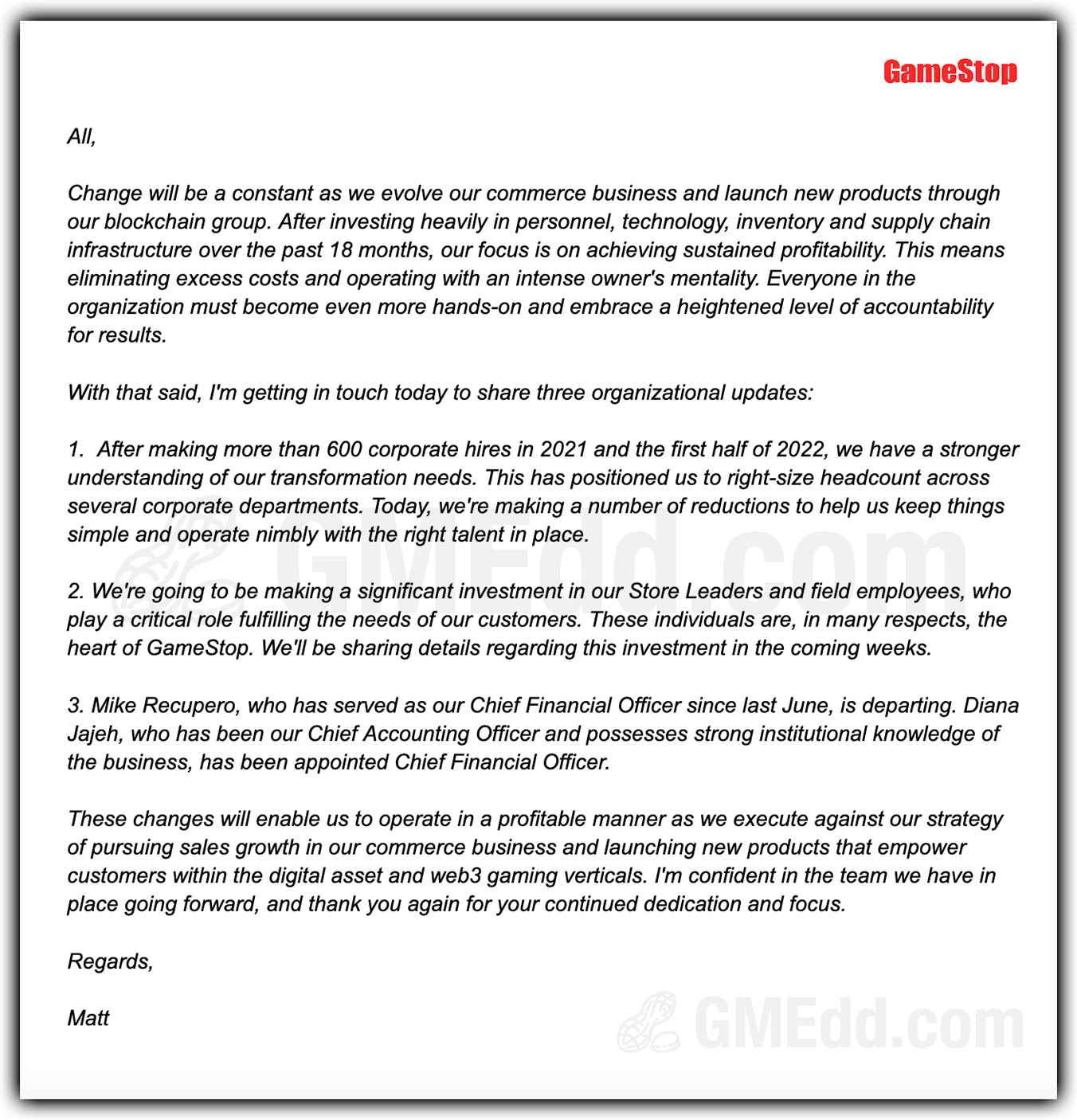

GameStop’s CFO is out after just about a year, and an internal memo within the company has laid out a plan towards profitability.

GameStop has fired its Chief Financial Officer, Mike Recupero, and is making staff cuts across departments as part of an aggressive turnaround plan, the video game retailer revealed Thursday.

Mike Recupero, a seasoned technology industry finance executive who spent more than 17 years at Amazon, was announced as the incoming CFO on June 9th, 2021 under Chairman Ryan Cohen’s guidance.

The sudden departure of Recupero appears less-than-amicable, as GameStop’s Form 8-K filing reveals he was terminated without cause effective immediately.

GameStop’s Form 8-K filed July 7th, 2022.

Simultaneous to Recupero’s termination, long standing Chief Accounting Officer Diana Saadeh-Jajeh has assumed the role of Chief Financial Officer.

She will have a starting annual salary of $200,000, according to the filing, and will be eligible for a “transformation bonus” in an aggregate amount of $1,965,000.

After about a year with the company, Recupero was “fired because he was not the right culture fit” and was “too hands off,” a person familiar with the matter told CNBC.

He was pushed out by GameStop Chairman Ryan Cohen, the person said.

In May, GameStop Board Member Larry Cheng stated that a down market tests whether the Chief Financial Officer is a leader. He went on to state that a culture-driving CFO can be a huge asset to companies in these down markets.

Larry Cheng on Twitter on May 11, 2022

“A down market tests whether the CFO is a leader. If the CFO is more of a back-office administrator playing a support role, companies can falter during these times. If the CFO is a culture-driving, agenda-setting leader, it can be a huge asset to companies in down markets.”

Cheng’s belief that a CFO acting more as a back-office administrator playing a support role can lead to a company faltering during a down market sounds familiar to the claims that Recupero was terminated for being “too hands off,” leading us to speculate that Cheng’s tweet was indicative of the situation at GameStop.

The Board Member also shared some evolving theory and observation related to CFOs on Twitter in January.

Larry Cheng on Twitter on January 31, 2022

“Evolving theory/observation: CFOs who know the key metrics of their business usually present to the board through organized slides. CFOs who aren’t sure about the key metrics often present to the board by navigating an extensive spreadsheet.”

The tweet from January indicates Cheng’s expectations for CFOs. The board member expects financial officers to present their key metrics in an organized manner, and that navigating extensive spreadsheets instead is a lack of understanding.

Larry Cheng’s Volition Capital is invested in a number of businesses so there is little evidence these tweets are about Recupero, but they say a lot about Cheng’s values.

GameStop is also undergoing several organizational updates, including layoffs and investing in field employees, in a strive towards profitability.

The layoffs, which were announced by CEO Matt Furlong in an email memo to all employees, are on the corporate side of the company rather than at its stores, and are intended to “reduce bloat” as GameStop invests in other areas.

GameStop’s internal memo sent after market close on July 7th.

Furlong’s memo begins by highlighting the company’s evolving commerce business and new products in the company’s launching blockchain group.

The Chief Executive goes on to state that the company is now focused on achieving sustained profitability.

“After investing heavily in personnel, technology, inventory and supply chain infrastructure over the past 18 months, our focus is on achieving sustained profitability. This means eliminating excess costs and operating with an intense owner’s mentality.”

The CEO also contextualizes the cuts, and says the company has made 600 corporate hires since last year. Moving forward, the company will invest in store leaders and field employees, although specifics are yet to be announced.

The memo claims the hiring frenzy of last year and the first half of 2022 has positioned management to “right-size headcount” across several corporate departments.

To conclude, Furlong states that the changes will enable the company to operate in a profitable manner as it executes the strategy of pursuing sales growth and new product launches.

“These changes will enable us to operate in a profitable manner as we execute against our strategy of pursuing sales growth in our commerce business and launching new products that empower customers within the digital asset and web3 gaming verticals.”

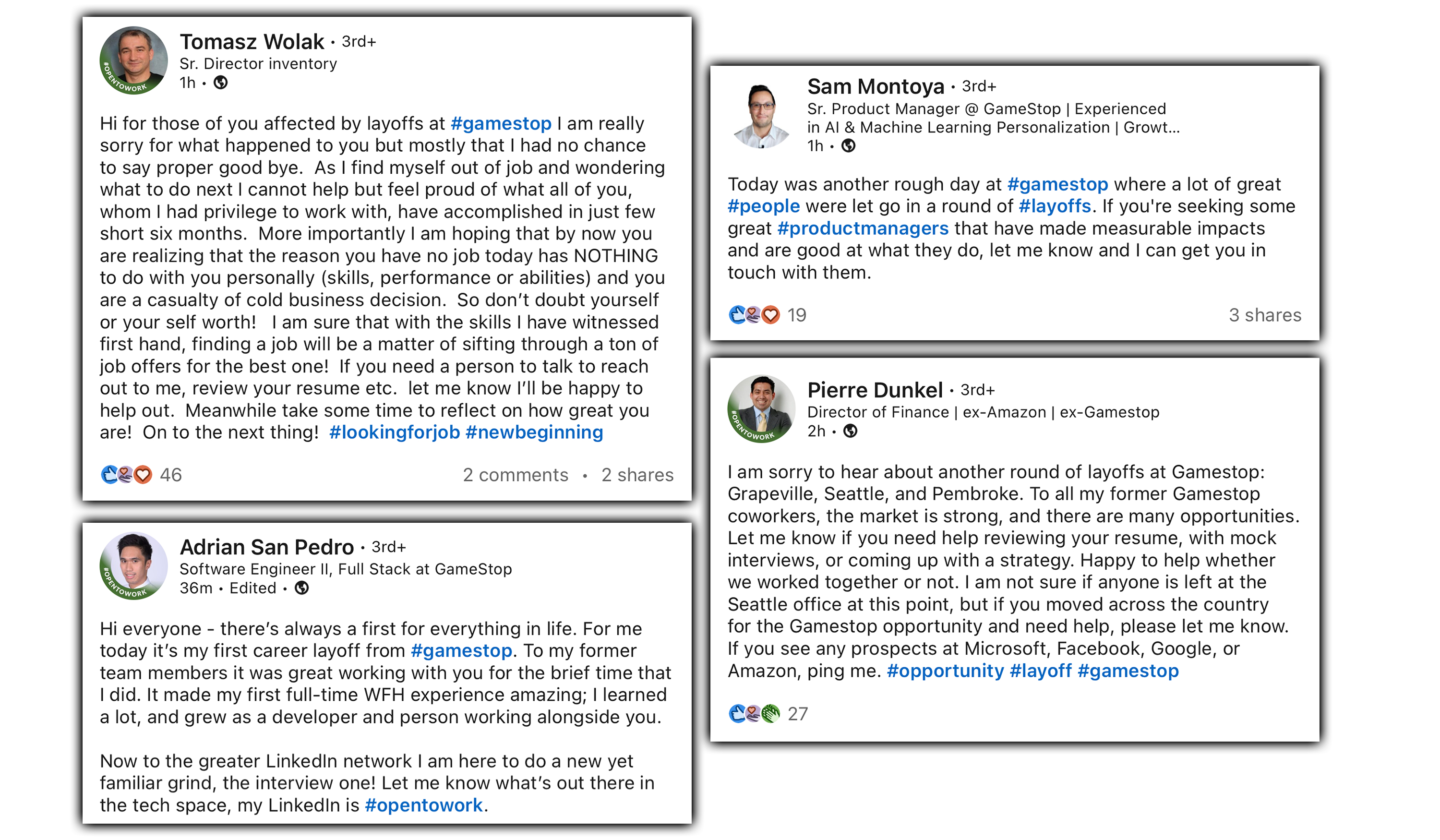

Several employees have made their layoffs known on LinkedIn, including Senior Directors and Software Engineers.

Pierre Dunkel, a former Director of Finance at GameStop, offered to help review resumes and engage in mock interviews for his coworkers.

LinkedIn posts by former GameStop employees on July 7th, 2022.

Dunkel also states that he is “not sure if anyone is left at the Seattle office at this point.”

GameStop had only recently expanded to Seattle, Washington, as part of an initiative uncovered by GMEdd.com in July 2021 that sought to reach a broader talent pool.

Rumors have surfaced that around 20% of corporate hires have been laid off, indicating that not all individuals who were brought on board during the hiring frenzy were compatible with the business; something to be expected during rapid growth.

Posts from LinkedIn on July 7th, 2021.

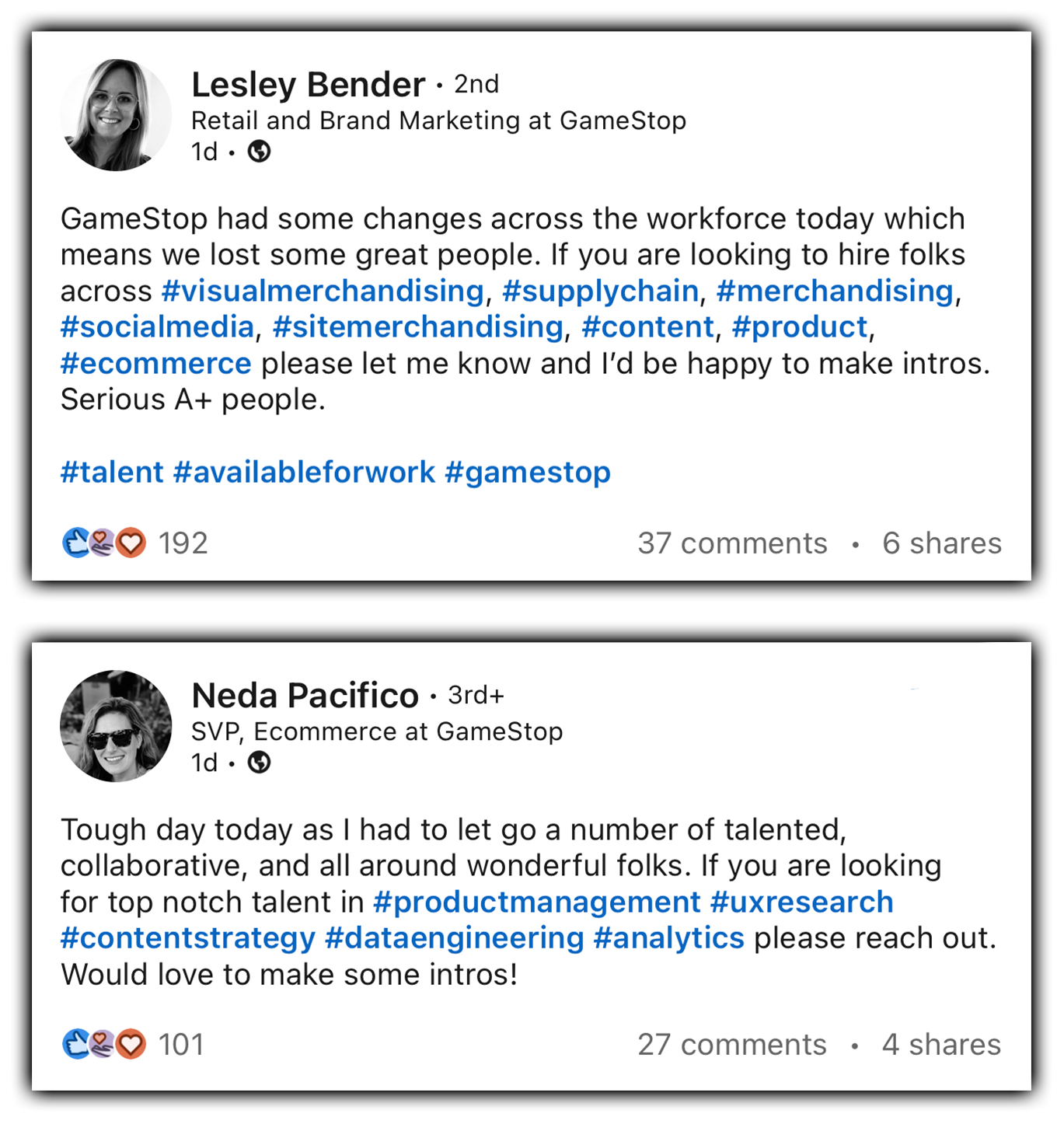

Posts on LinkedIn from Lesley Bender and Neda Pacifico of GameStop work to clue investors in on the departments facing downsizing.

“If you are looking to hire folks across visual merchandising, supply chain, social media, site merchandising, content, product, ecommerce, please let me know and I’d be happy to make intros.”

SVP, Ecommerce Neda Pacifico’s July 7th post also adds that individuals in analytics, data engineering, and user experience research were let go.

Hearsay also claims that no blockchain team members were included in the layoffs.

Through rapidly expanding GameStop’s corporate team with six hundred hires in just over a year, not everyone found compatibility with the start-up mentality that Chairman Ryan Cohen brought to the transforming business.

With GameStop committed to an NFT Marketplace launch by the end of the month, the results of the past year’s work will soon begin to unfold.

Sources: GameStop Form 8-K, CNBC, Neda Pacifico on LinkedIn, Lesley Bender on LinkedIn, Tomasz Wolak on LinkedIn, Adrian San Pedro on LinkedIn, Sam Montoya on LinkedIn, Pierre Dunkel on LinkedIn, Larry Cheng on Twitter, Larry Cheng on Twitter

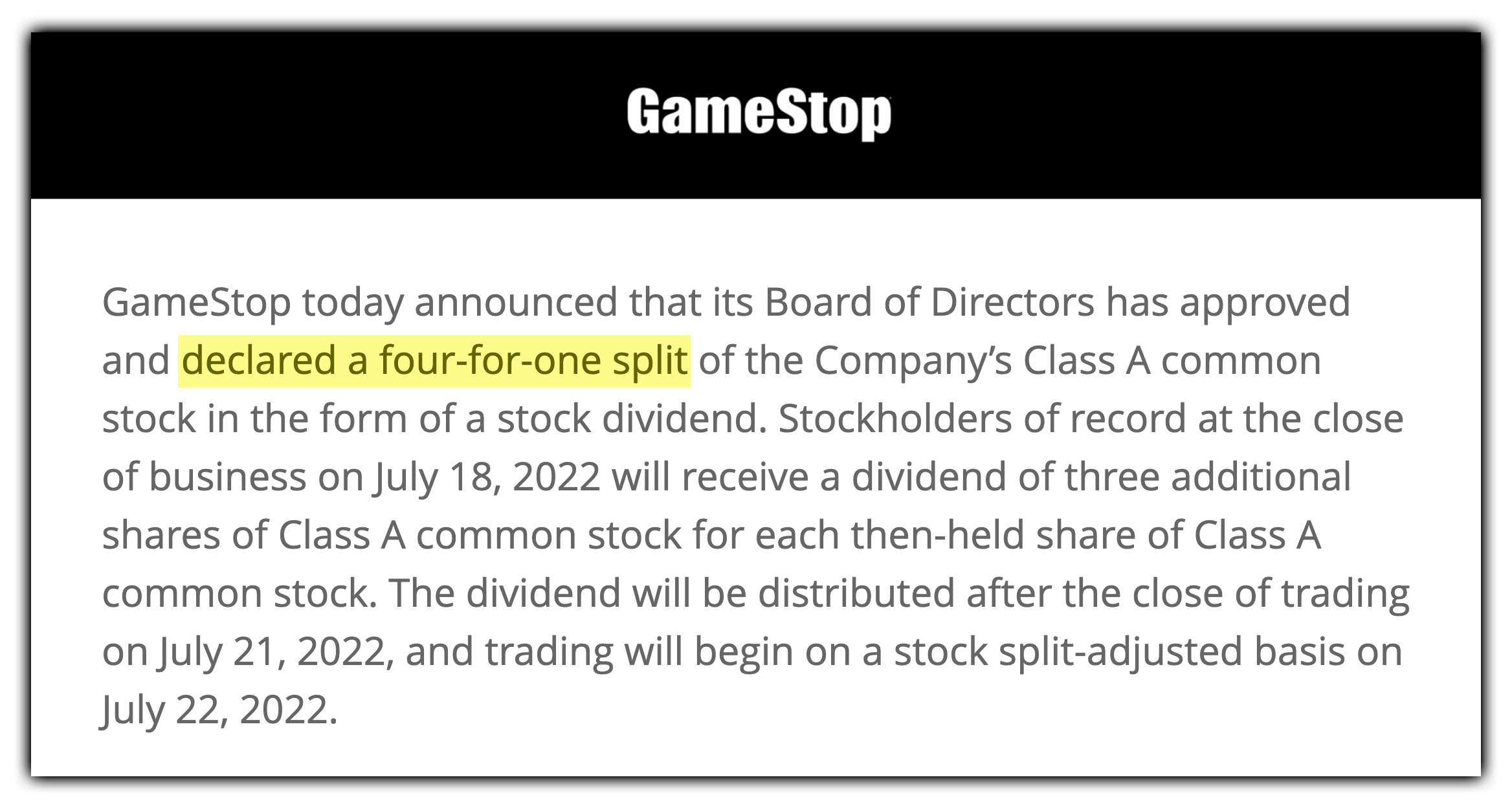

As an NFT Marketplace launch nears, GameStop has declared the company’s stock split, a move long encouraged by retail investors in the stock.

GameStop Corp. today announced that its Board of Directors has approved and declared a four-for-one split of the company’s common stock in the form of a stock dividend.

Company stockholders of record at the close of business on July 18, 2022 will receive a dividend of three additional shares of common stock for each then-held share of common stock.

The stock dividend will be distributed after the close of trading on July 21, 2022. Trading will begin on a stock split-adjusted basis on July 22, 2022.

GameStop’s Investor Relations on July 6th 2022.

GameStop first announced the company’s intention to split their stock 3 months ago on March 31, 2022.

For nearly a year, retail investors have speculated if GameStop would ever engage in a stock split. Even GMEdd.com published tongue-in-cheek conspiracy when Chairman Ryan Cohen shared a photo of himself with split chopsticks under his nose.

GameStop’s declared stock split plan will be completed through a stock dividend, which awards existing shareholders with new shares. Unlike a typical stock split where already held shares are divided, in a stock dividend additional shares are allotted to existing shareholders.

GameStop currently has 76.13M shares outstanding pre-split and will have 304.52M shares outstanding post-split.