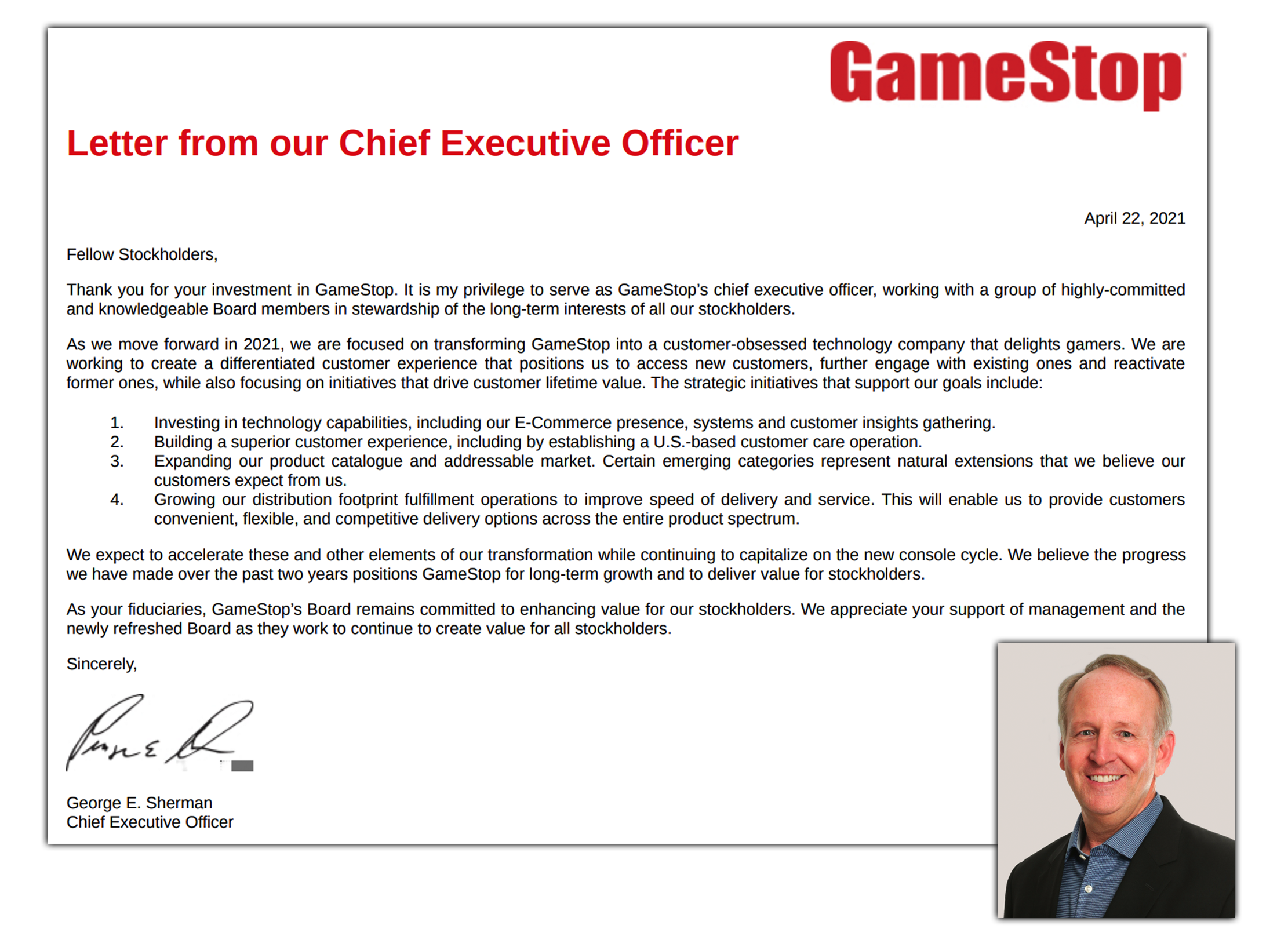

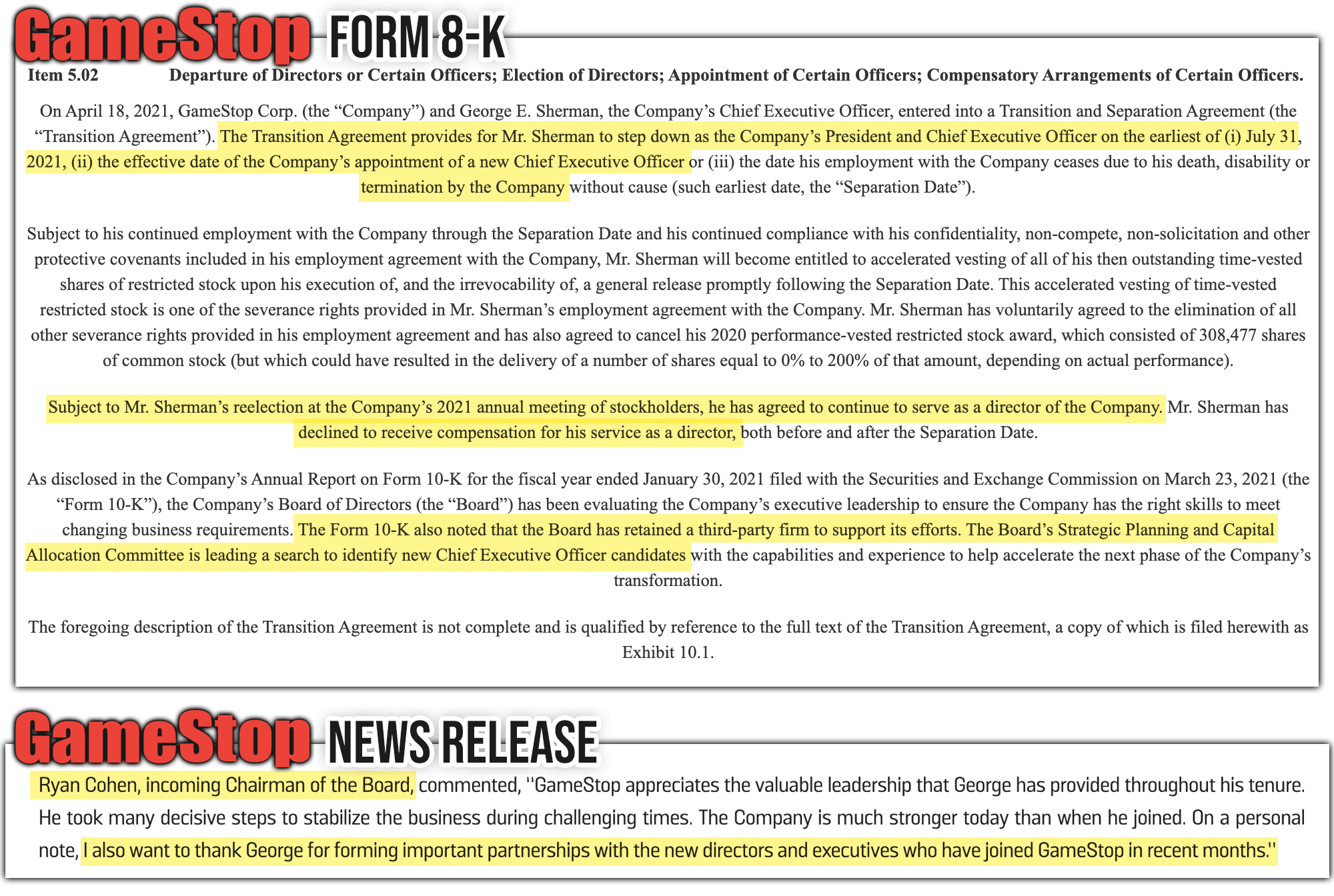

In GameStop Corp.’s April 22nd’s Schedule 14A filing, George Sherman issued a letter to GameStop shareholders, likely his last as CEO of the gaming company.

Thank you for your investment in GameStop. It is my privilege to serve as GameStop’s chief executive officer, working with a group of highly-committed and knowledgeable Board members in stewardship of the long-term interests of all our stockholders.

Sherman takes the opportunity to remind GameStop shareholders of the strategic initiatives in place to support the goal of creating a customer-obsessed technology company that delights gamers.

-

Investing in technology capabilities

Including our E-Commerce presence, systems and customer insights gathering.

-

Building a superior customer experience

Including by establishing a U.S.-based customer care operation.

-

Expanding our product catalogue and addressable market

Certain emerging categories represent natural extensions that we believe our customers expect from us.

-

Growing our distribution footprint fulfillment operations

To improve speed of delivery and service. This will enable us to provide customers convenient, flexible, and competitive delivery options across the entire product spectrum.

The soon-departing CEO wraps up the letter with by thanking shareholders for their appreciation towards the newly-refreshed board, all thanks to Ryan Cohen.

As your fiduciaries, GameStop’s Board remains committed to enhancing value for our stockholders. We appreciate your support of management and the newly refreshed Board as they work to continue to create value for all stockholders.

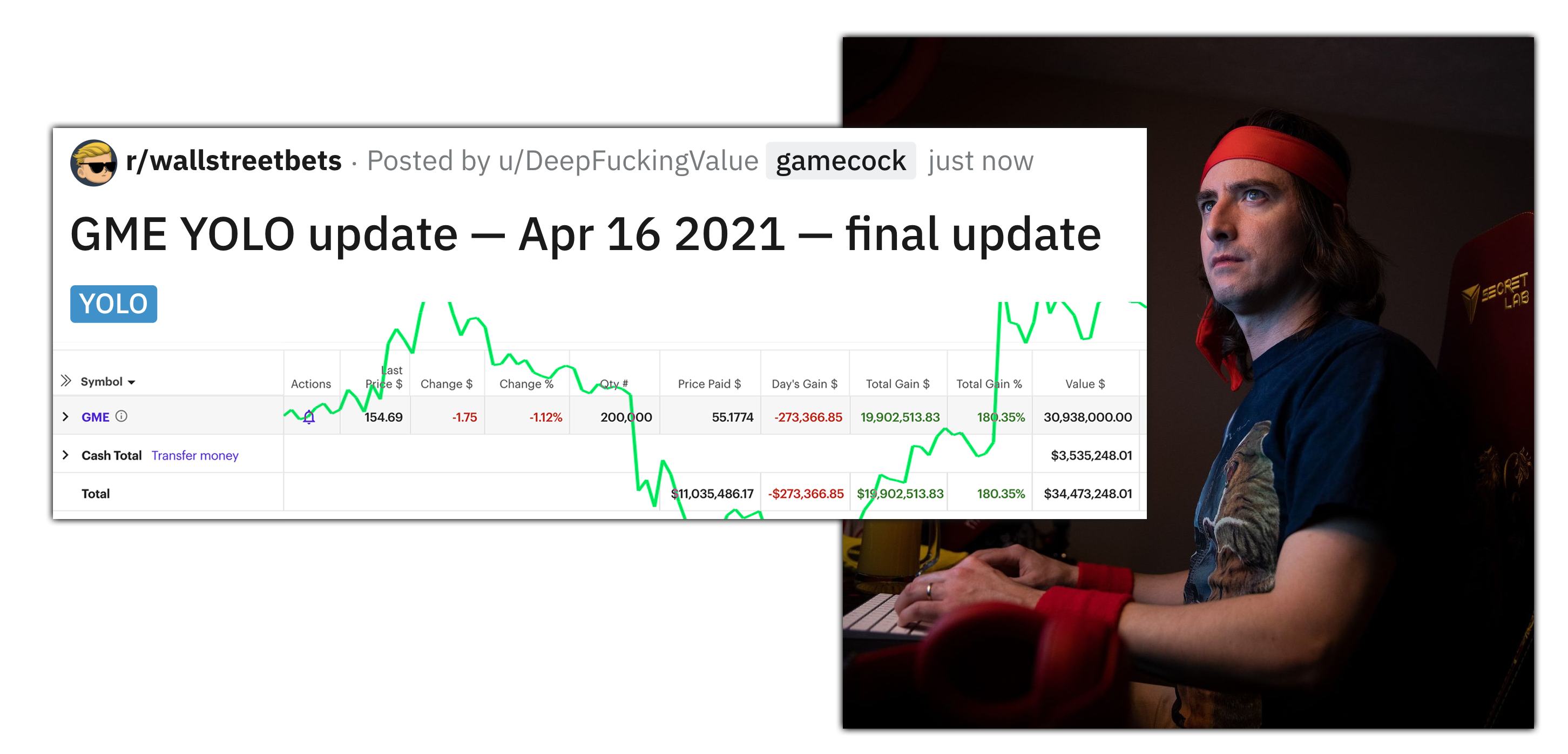

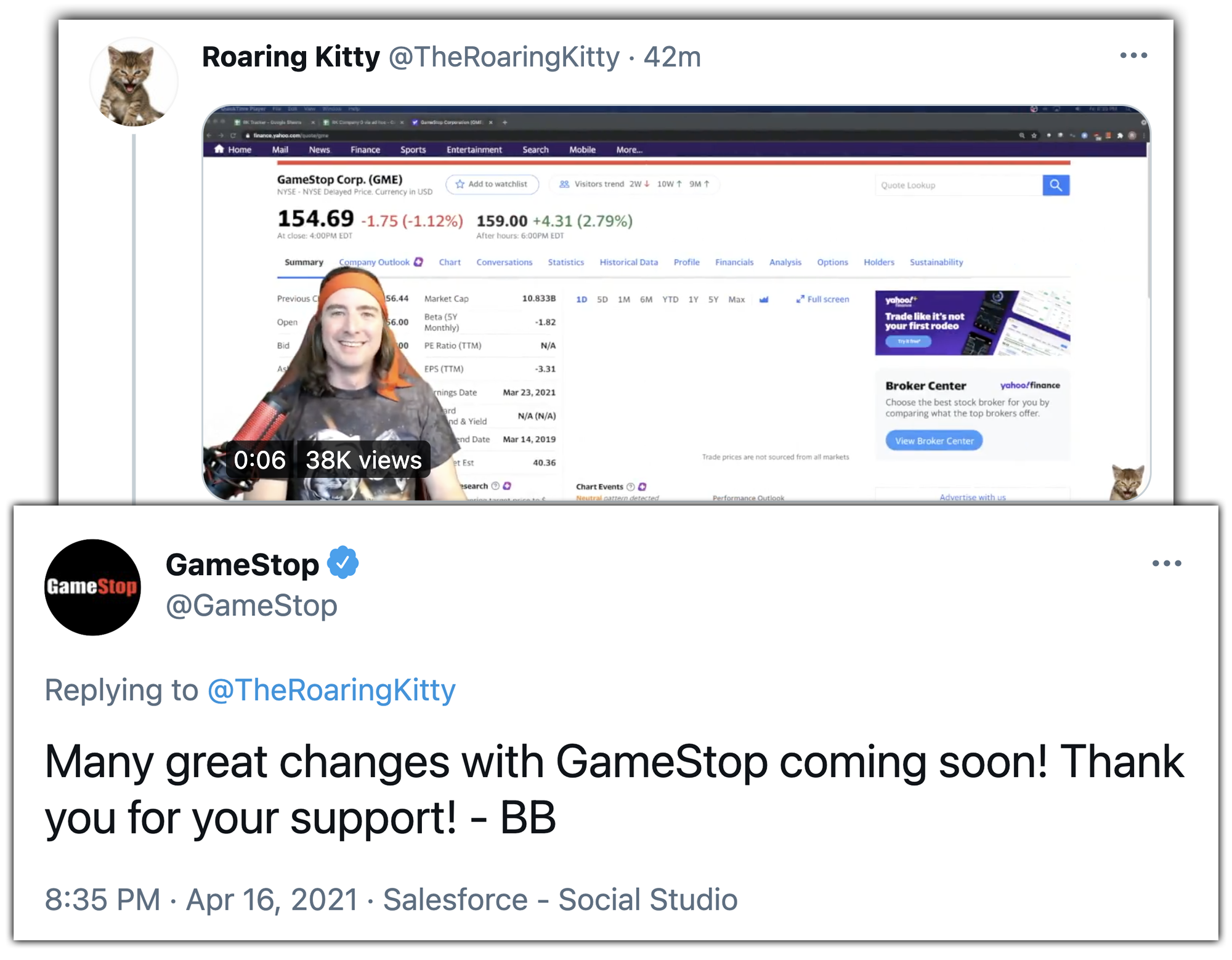

At 4:20 PM on April 16th, 2021, Roaring Kitty revealed

At 4:20 PM on April 16th, 2021, Roaring Kitty revealed